We will never know who created Bitcoin—and that’s a good thing

GM,

This past week has been dominated by Satoshi Nakamoto, after HBO released its long-anticipated documentary aiming to answer the question of who created Bitcoin.

No spoilers just yet, if you haven’t seen the show, but the truth is that we don’t need to know Satoshi’s true origin. In fact, it is essential that we don’t, as we explain today.

Best,

What’s going?

Bitcoin is across the news this month following the release of HBO’s Money Electric: The Bitcoin Mystery, a documentary tasked with identifying the anonymous creator of Bitcoin. Identifying the person beyond the name would be huge.

Here’s why:

- Satoshi wrote the Bitcoin whitepaper in October 2008 and launched Bitcoin in January 2010

- He is estimated to own at least $40 billion in Bitcoin, according to today’s prices, which has never been touched

- He abruptly ceased being active online after December 2010

Spoiler alert—although this won’t come as a surprise to anyone who knows Web3 or has read the news headlines—HBO couldn’t identify who the mysterious figure behind Satoshi Nakamoto is.

That might leave some people unfulfilled, let alone surprised given just how massive Bitcoin is today, but it is actually a good thing. Not only do we not need to know who Satoshi is, but the cloak of anonymity serves Bitcoin, and by extension all of Web3, as we explain today.

SO WHAT?

1. Focus on technology

The core tenets of Bitcoin are privacy and hedging the global economy. Satoshi’s identity is proof that Bitcoin can succeed in both of these goals.

Satoshi did a number of things that would usually make a person identifiable:

- Bought a domain and created Bitcoin.org

- Participated in a cryptography-focused mailing list with scores of academics

- Created a Bitcoin forum and posted there often

- Created and owned potentially thousands of Bitcoin wallets (many were used for early mining rewards)

Online activity like this typically would leave a footprint through records, servers and more but Satoshi evaded detection. It is said he used Tor, the software for anonymous internet browsing, among other tools.

In addition, when one of his email accounts was hacked, the data that came out of that did not present any identifiable information.

That lack of figurehead has meant that it is the Bitcoin community that pushes development and deployment of technology. While it is true that this a community that’s rife with conflict, it ultimately means updates and additions are by, with and from the community rather than a single figurehead as is the case with Facebook, Google and other Silicon Valley companies.

This community-driven approach has led to the development of new technologies within Bitcoin, such as support for NFTs, memecoins, and other features that did not exist when Satoshi first launched Bitcoin. That ground-up approach of adding new features is Bitcoin’s differentiator. Its development is focused squarely on technology and the concept of decentralization financial systems. It is a product of and for its users, not one run at the behest of a management team.

Satoshi's anonymity reinforces the decentralized nature of Bitcoin. By not having a visible leader or figurehead, Bitcoin can be seen as a community-driven project, free from the influence of any single individual. This keeps the focus on the technology and the concept of a decentralized financial system, rather than on a personality. Bitcoin can thus evolve through collective consensus, independent of personal biases or influence.

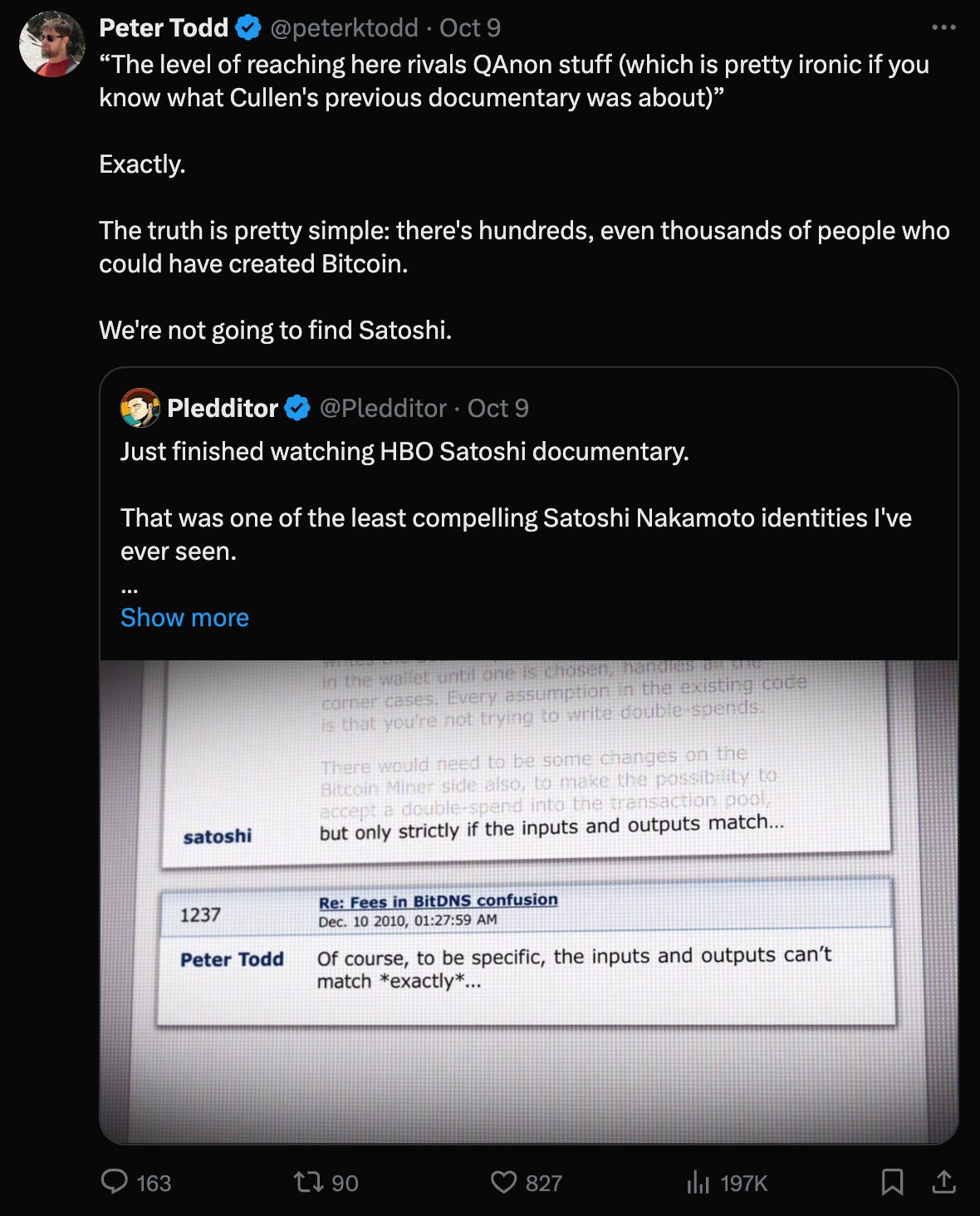

Bitcoin developer Peter Todd was heavily linked with being Satoshi in the HBO documentary, he denied that he is and refuted the explanation put forward

2. The ultimate Bitcoin whale is best unknown

Adrian Chen, a journalist who had tried to contact Nakamoto in the early days of Bitcoin, once argued that knowing the man or woman behind the mask is essential because the wallets under Satoshi’s ownership are so vast and represent a huge percent of Bitcoin.

Writing in 2014, he said:

But the idea that Nakamoto’s identity is irrelevant is wishful thinking. Most obviously, Nakamoto’s identity matters because he is estimated to control four hundred and forty-eight million dollars' worth of bitcoin, which, if it were unloaded quickly, could seriously depress the value of the notoriously volatile currency.

Things have changed hugely over the last 10 years.

The price of Bitcoin is up 60X since that article was published and more wallets likely belonging to Satoshi have been discovered. Over that decade, the game has changed for Bitcoin too. Institutional capital has entered the cryptocurrency in a way that was unthinkable even just five years ago let alone when Bitcoin launched in 2009.

The introduction of Bitcoin ETFs in the US and other countries means that major financial institutions have exposure to Bitcoin. The rest of the Web3 market, including Ethereum and by extension Ethereum ETFs, adjusts to Bitcoin’s price, too, as we saw last year.

All of this progress makes Chen’s words more significant but, rather than needing to know the identity, Bitcoin needs Satoshi to remain anonymous.

Any identifiable individual would represent a single point of failure for all of Bitcoin. Since Bitcoin is a threat to currency and sovereignty, that person would be at risk from nation states and other actors.

The US government has gone after Wormhole, the Web3 mixer that has been used by criminals and terrorists, with arrest warrants for its founding team. Then there’s Telegram, whose future has been in question since its CEO Pavel Durov was arrested in France this summer. Outside of Web3, too, we see Apple being forced to follow law in China around banning and apps in content in order to be compliant in the country, which accounts for around 20% of global sales.

That’s just a taste of the kind of hostility that heads of disruptive tech companies can expect.

3. Identity best unknown

Finally, Satoshi’s disappearance allows Bitcoin to stand out in a Web3 world that is so often about personality.

- Vitalik Buterin represents Ethereum

- Justin Sun and TRON are indistinguishable

- Brad Garlinghouse courts controversy to bring attention to Ripple

- Solana’s founders constantly represent their foundation

- Charles Hoskinson and Cardano are synonymous

These figureheads no doubt help their respective organizations to maintain a high-profile, but there are plenty of downsides that come with the association.

Buterin, for instance, has his every crypto transaction analyzed and assessed. The attention he receives is so great that projects often transfer unsolicited tokens to him to generate marketing buzz. (His response is to sell them and donate the proceeds to charity.) In the period of ICOs, projects often took photos with him to put on their website or social media for clout and validity.

There’s often the risk that a cult of personality can overshadow a project. Sun, meanwhile, is known for being brash and divisive. He just became acting Prime Minister of an Eastern European microstate called Liberland, and he was previously an ambassador for Grenada.

Ethereum at times can feel that way, too. Whether it is Buterin singing on stage at a conference—as we wrote about Token2049—or pledging support for the existence of a Hezbollah betting section on predictions platform Polymarket, it can get thorny when these leaders speak and represent their projects.

Andreas Antonopoulos, an academic and author who has worked in the Bitcoin space since 2012, expertly explained why Satoshi Nakamoto’s anonymity is a positive benefit for Bitcoin:

As I have expressed many times in the past, I think the identity of Satoshi Nakamoto does not matter. More importantly I think it serves to distract from the fact that bitcoin is not controlled by anyone and is not a system of Appeal-to-Authority. Identifying the creator only serves to feed the appeal-to-authority crowd, as if SN is some kind of infallible prophet, or has any say over bitcoin's future.

Identity and authority are distractions from a system of mathematical proof that does not require trust. This is not a telenovela. Bitcoin is a neutral framework of trust that can bring financial empowerment to billions of people. It works because it doesn't depend on any authority. Not even Satoshi's.

The HBO documentary has also shown that intrigue around Satoshi’s identity is box office gold, too. That storyline is one way that a new audience might engage with Bitcoin for the first time, and grow the strength of the network and adoption.

If nothing else, we are guaranteed good television from the show. We recommend going to watch it.

News bytes

Stripe has reintegrated support for crypto payments in the US seven years after it ceased support—customers can pay using stablecoins USDC or USDP on Ethereum, Solana, and Polygon, but merchants receive US dollars

Almost half of traditional hedge funds are now dabbling in crypto, that’s up from 23% last year and it follows the launch of ETFs in the US, Hong Kong and other markes, according to a report from PwC and the Alternative Investment Management Association

The South Korean government’s newly-formed Virtual Asset Committee will discuss the potential to approve cryptocurrency ETFs and allow corporate accounts to hold digital assets

Ripple is the latest to jump into stablecoins—its RLUSD token is close to launch after it announced the exchanges that will support it

Mysten Labs has denied claims that an insider at Sui Foundation, its organization controlling the layer-1 blockchain Sui, sold $400 million in tokens as its token price began to take off—the price is up 85% over the last month

Telegram once joked that it rarely checked its compliance email account. But following CEO Pavel Durov’s arrest in France this summer, it is making efforts to be compliant. It’s latest move is in Kazakhstan where it plans to open a local office an “important step to increase control over content”

That’s all for this week!

Share your feedback, questions or requests via email to: sowhat@terminal3.io