Web3 grew up in 2023—here's how we expect it to mature in 2024

GM!

Welcome to 2024. We aren’t even two weeks into the new year, and it has already been historic: the first Bitcoin ETFs have been approved in the US and are already trading! Which brings us to our first SO WHAT series for 2024 … Web3 is Growing Up.

The timing of the ETF approvals was impeccable, coming exactly 15 years after software engineer Hal Finney tweeted that he was “running Bitcoin”—the first mention of Bitcoin on a social network and a moment remembered as crypto’s introduction to mainstream internet users.

The new year’s surprise also works for us here at SO WHAT. We believe that the decentralized economy will begin to ‘mature’ this year, and this series will examine how regulated digital assets could dominate the 2024 narrative, and finally bring crypto relevance to the masses. Join us over the next three weeks as we dive-in.

Best,

Gary and Jon

What’s going on?

2023 was a remarkable year for Web3, but not for the reasons many in the industry were hoping for.

Last year was packed with controversy as founders of multiple industry titans—including FTX and Binance—were brought to justice for crimes including money laundering, fraud and more. While the bad apples were tossed out, financial regulators worldwide began to take digital assets seriously. Asia led the way with jurisdictions like Hong Kong, Singapore and Japan introducing policies and regulations are encouraged blockchain innovation and the bridging of traditional finance and the decentralized economy.

In short, the Web3 industry started to grow up, as we noted in our annual recap.

Over the next few weeks, we will explore three key areas of maturation that will have significant impact.

SO WHAT?

1. The first US Bitcoin ETFs arrive and make an impact

Exchange traded funds (ETFs) are vehicles that give investors access to assets without direct ownership and via the stock market.

ETFs for crypto are not new. Countries including Sweden, Germany and Australia have offered Bitcoin ETFs for many years, but the US joining the party is a huge deal as it gives major financial institutions in the world’s largest economy a regulatory compliant avenue for exposure to crypto. Major financial players weren’t able to buy or hold Bitcoin for reasons that include regulatory uncertainty and logistical challenges of asset management.

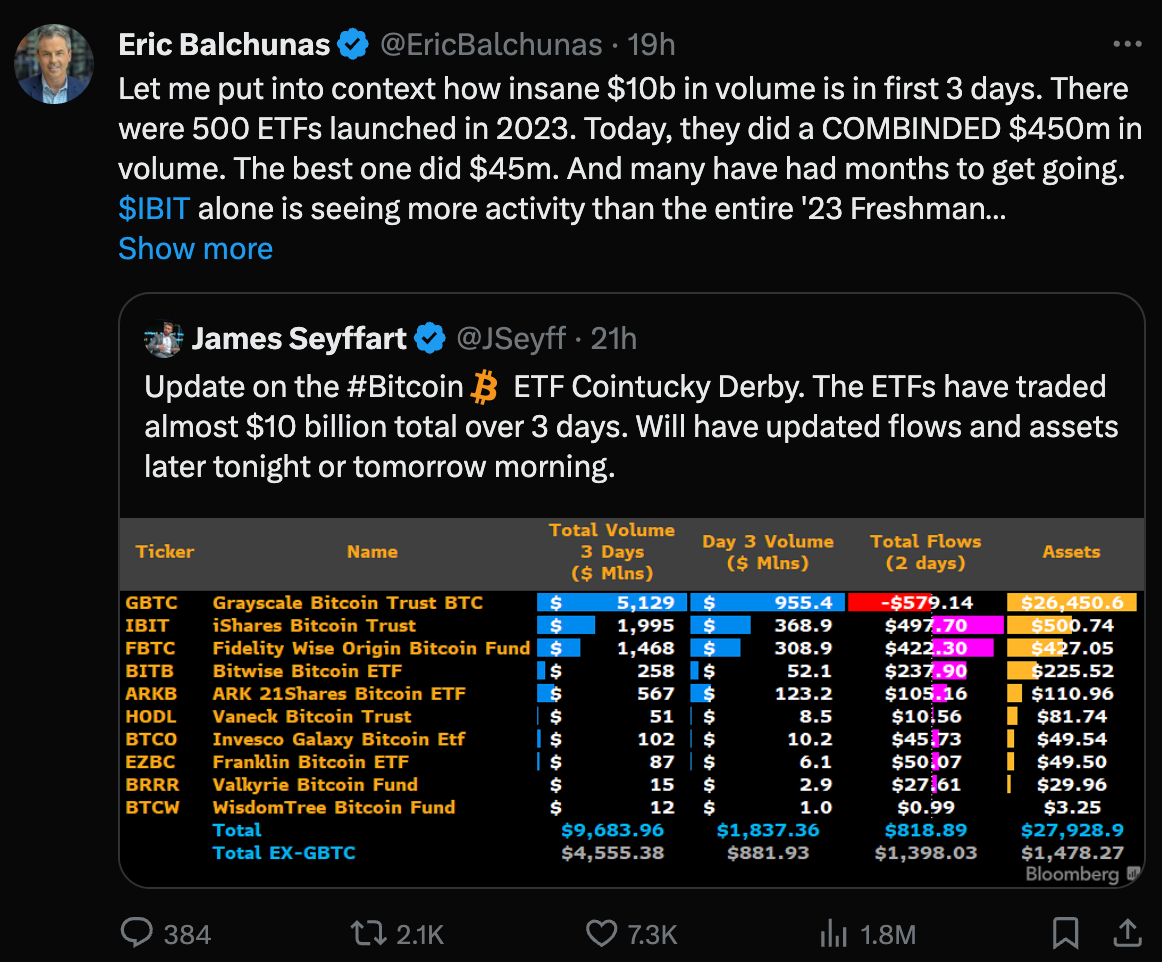

The advent of ETFs is a boon for institutions that want to park a fraction of their assets in a high-growth alternative asset like Bitcoin, while it also gives crypto further legitimacy via billions in new capital from institutional and professional investors. The new US ETFs did $4.8 billion in trading collectively on their first day. That’s more than double the previous opening-day record, and it added around 10% to Bitcoin’s usual daily trading volume.

Already, markets like Hong Kong are looking into Bitcoin ETFs so we can expect others to follow the US. Such a domino effect will only add to the validation and capital pools that the US ETFs are bringing.

2. Stablecoins win true appreciation—and profit

On the face of it, stablecoins are not sexy because Web3 and crypto are still primarily for speculators. Buyers of tokens do so in the hope they will “moon” (rise significantly in value). Stablecoins, as the name suggests, are designed to be free of that volatility; an oasis of calm in a sea of moon-ing and crashing.

This stability is crucial for a few reasons. Crypto traders use them to ‘park’ fiat currency prior to transactions, and stablecoins are also the foundation of defi liquidity pools (where tokens are ‘paired’ to facilitate decentralized trading). But their potential use is even broader, and they could help usher in greater Web3 adoption and maturity. Singapore, China and other countries are trialing digitized versions of their currencies for areas like financial institution settlement, cross-border transfers and more.

But it isn’t just a concept for governments, there’s money to be made. Tether is not only the issuer of the world’s top stablecoin (USDT) but it is the tenth largest holder of Bitcoin (worth nearly $3 billion thanks to savvy investing) and with tidy quarterly profits of $850 million. Circle, its closest rival, has reportedly filed for a US IPO this year—its financials will make for fascinating reading.

3. Real World Assets show signs of taking off

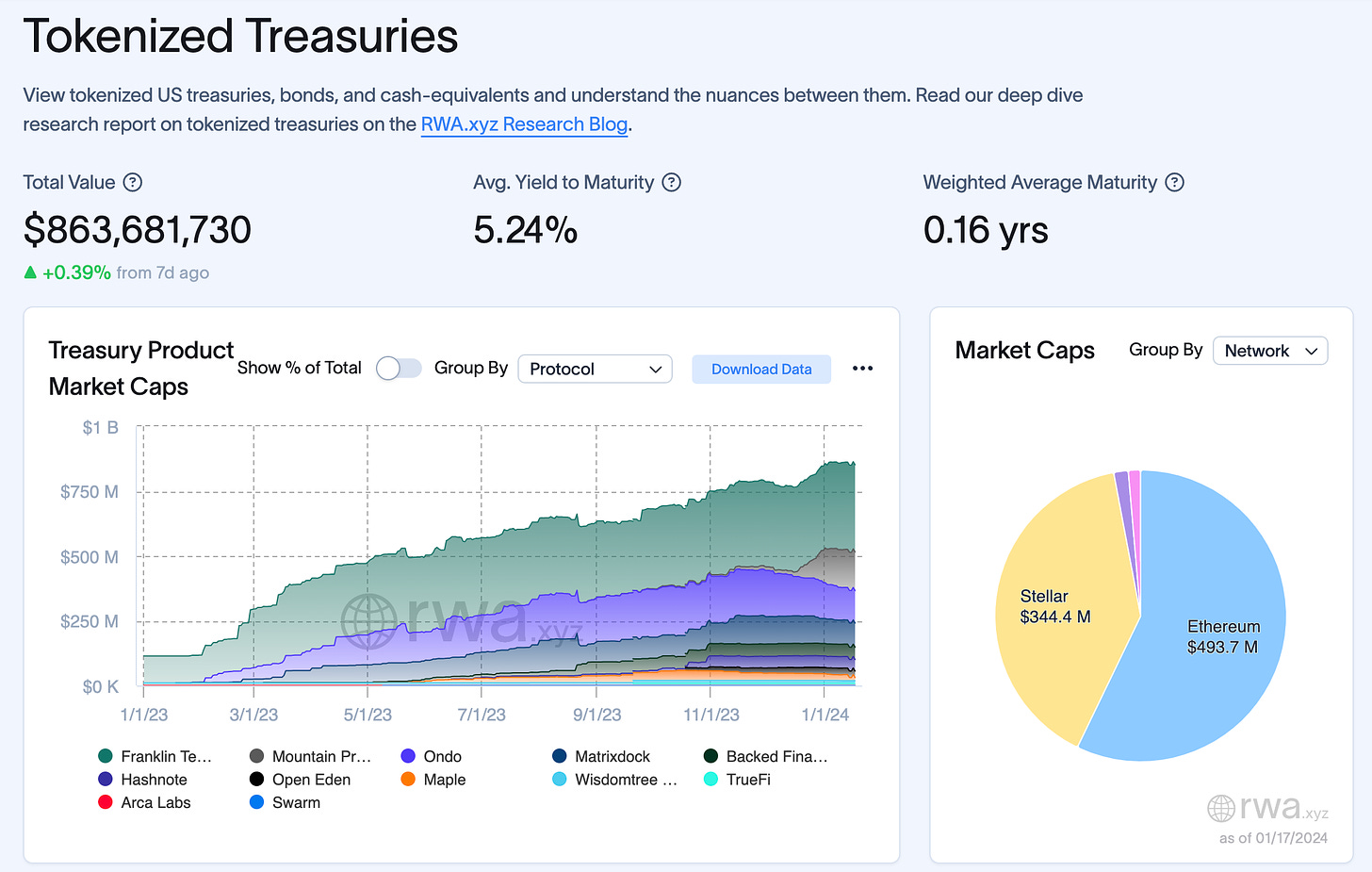

Finally, it’s impossible to ignore real world assets, or RWA. Stablecoins are a prominent example because they are tokenized versions of a physical asset, in this case currency. Financial products are a major focus for RWA, with private equity, credit and bonds all tokenized on blockchains in order to reduce cost and increase accessibility for investors, and also give new levels of transparency.

Financial products have grown impressively—with over $860 million tokenized in US treasuries—but the RWA trend also includes more exotic areas such as real estate, art ownership, cars and any other collectibles. In these cases, the blockchain acts as an ultimate ledger of proof of ownership, whilst enabling full transparency and 24/7 trading.

In recent years, membership programs from the likes of Starbucks, Reddit and Disney have gone on-chain for similar reasons. Brands including Coca Cola, Adidas and others have made less successful forays, too.

Be sure to keep an eye on our newsletters for the next month as we dive deeper into these topics, and explain why they are significant not just for the Web3 community but the broader tech industry, too.

News bytes

The SEC had its Twitter account hacked to prematurely announce of approval of US Bitcoin ETFs—the agency says that breach was down to unauthorized access using an associated phone number

Following Bitcoin, Ethereum is tipped to be next to get ETF treatment but experts are doubtful that will come before May

Circle’s CEO says there’s a “very good chance” that the US publishes regulation around stablecoins this year

Blockchain firm Solana opened sales for the a second version of its smartphone, the original became a hit following a price in recent months despite sluggish initial sales after its release last year

Binance’s predictions for trends in Web3 this year includes: Bitcoin narrative dominance, increased connection to AI, RWA and accelerated institutional adoption

That’s all for this week!

You can share your feedback, questions or requests via email to: sowhat@terminal3.io