Tokenized funds are on the rise—no wonder JPMorgan wants a piece of the action

GM,

Earlier this month, 150-year-old bank Goldman Sachs said it plans to launch its first tokenized funds. The news generated plenty of attention—but why?

The premise is that tokenized funds will knock down the walls and allow anyone to enjoy access to financial instruments that are currently only for the wealthy and privileged. But it’s a long road with plenty of twists and turns.

Join as we dig into why this latest chapter could be a big deal for Goldman and the wider Web3 and banking industry.

Best,

PS: A note on housekeeping, the SO WHAT team is spread across the world for the next few weeks. As a result, the newsletter may be published at uneven times until we are all back in Asia again. We appreciate your understanding—enjoy the summer wherever you are!

What’s going on?

Goldman Sachs plans to launch three tokenized funds before the end of this year, which will include dedicated funds for the US and Europe, according to Mathew McDermott, who leads its digital assets business.

Goldman’s newest foray into Web3 is noteworthy as it would see the firm join rivals such as JPMorgan in embracing the technology that underpins cryptocurrency for traditional banking services.

We’ve written extensively about how the largest trend in Web3 over the last 18 months has been the digitization of traditional financial services using Web3 technology, and not necessarily cryptocurrencies themselves. That’s significant as there is so much more to Web3 than cryptocurrencies—explaining that is one major reason why we write this newsletter.

SO WHAT?

1. Making fund investment easier for banks and investors

Tokenizing funds allows for easier investment and divestment for investors. Rather than running deals via brokers and middlemen, the core idea is to make buying them as simple as sending money to a friend via Venmo, Wise or a QR code scan in Asia.

Self-custody, aka owning your assets, is a key part of Web3 and while tokenized funds are operated by third-parties, investors can put their funds in or out whenever they want, and at any time. They’re not reliant on the fund owner releasing the funds or specific trading hours.

They can also radicalize exactly who can invest. Bank funds are usually restricted to accredited investors or institutions, meaning your average retail investor can’t enjoy the returns or security offered by traditional funds.

The rules are designed to prevent those without significant capital from losing money that would impact their life, but instead hopeful investors are gatekept from one of the most highly-sought after investment vehicles. Tokenization in its purest form flips that on its head to allow anyone to invest, regardless of their level of wealth or even where they live.

Limited access

Accredited investors are individuals who have made $200,000 or more over the last two years—that’s typically 5-6% of the US population. US investment products are typically not offered to those who live overseas.

For banks, tokenizing a fund saves money on operating costs and allows them to create a more diverse portfolio by accessing different asset types. Settlement of trades can take minutes rather than take days, and the blockchain-based approach allows greater transparency for those with money in the fund.

The broader idea of tokenized finance and Defi is to make finance products available to all investors, regardless of their income or country. But, as we will explain, that remains a work in progress when it comes to bank-based funds.

2. Tokenized funds are growing—but not changing the status quo

There’s plenty of evidence that tokenized funds are gaining steam. Over the last five years or so, they’ve gone from a pipe dream that was mocked by traditional financial players to a niche but growing play for banks seeking new digital products.

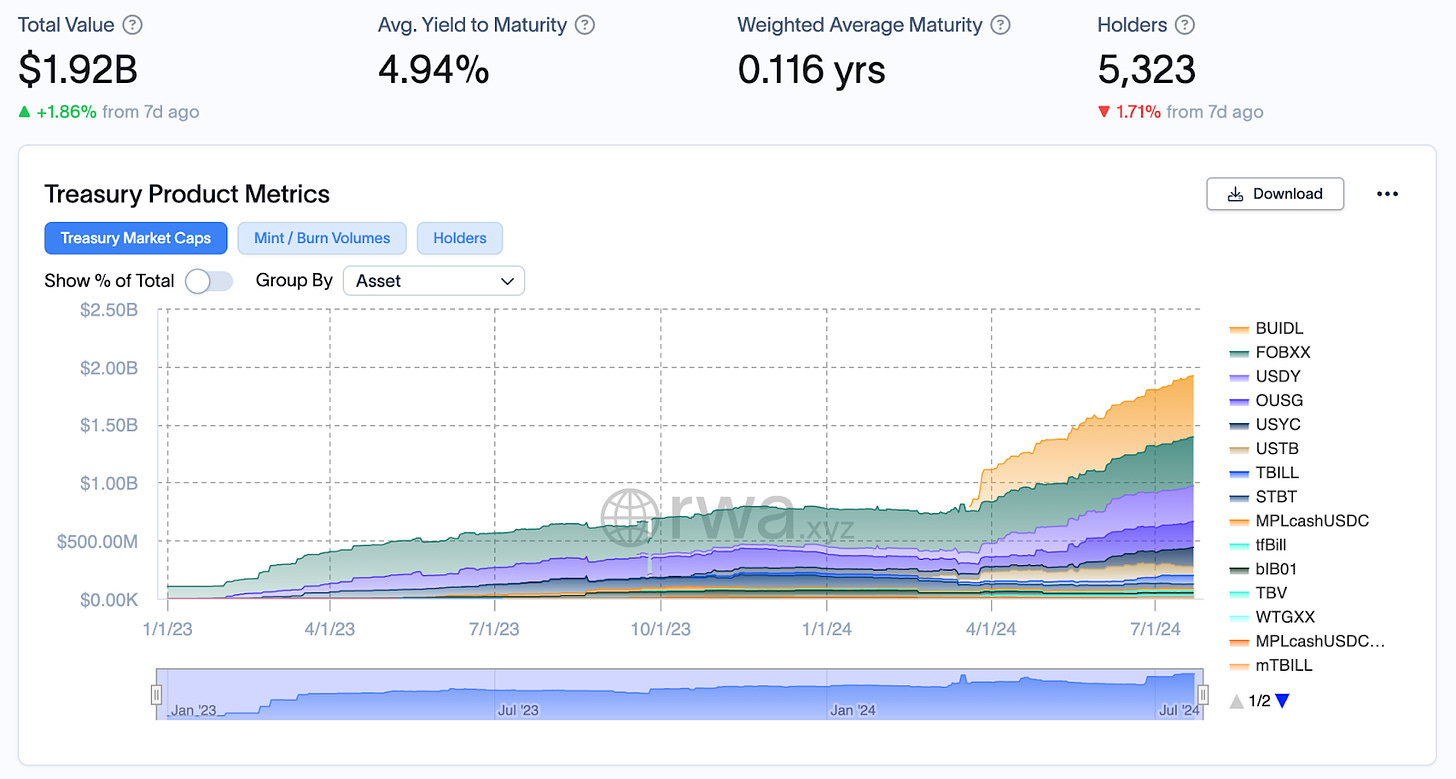

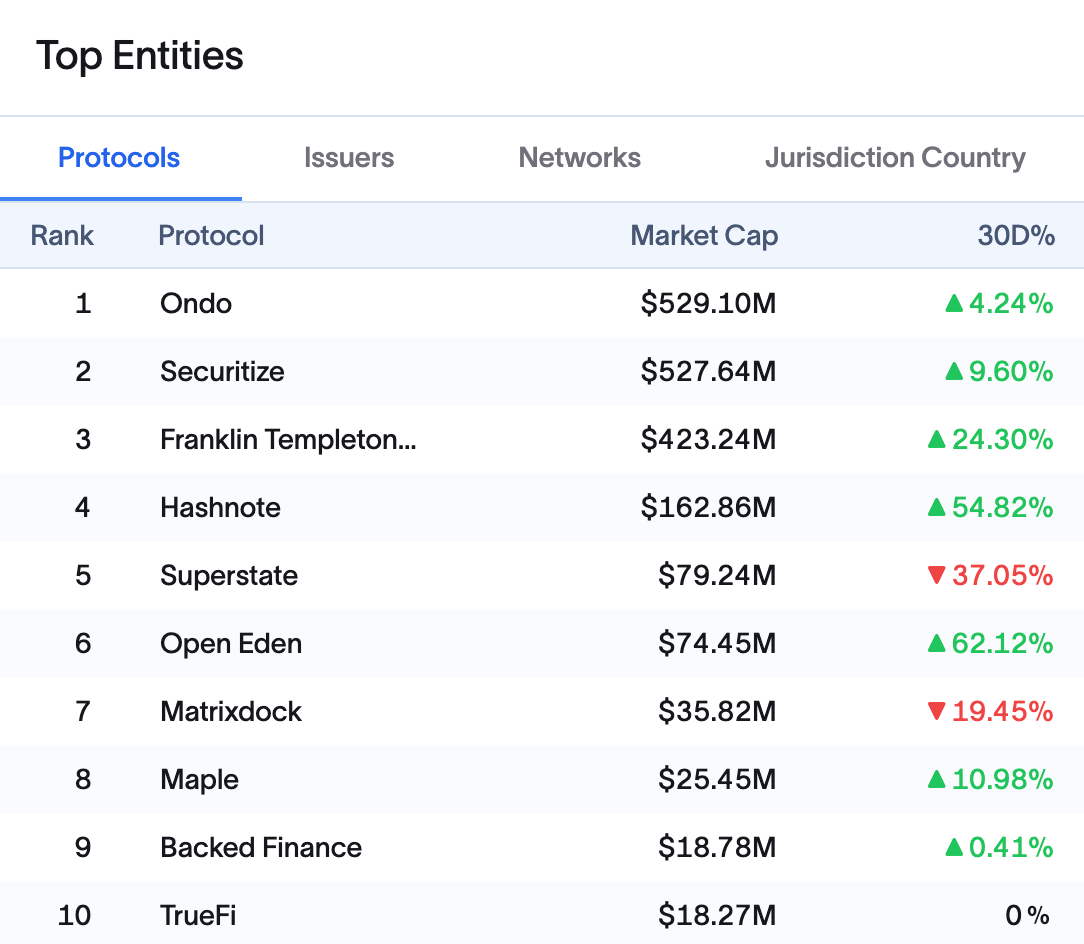

We wrote about tokenized treasuries in February and today, just over six months later, the total value of assets within tokenized funds has more than doubled from $860 million to $1.92 billion. A large part of that increase came from the launch of BlackRock’s BUIDL (BlackRock USD Institutional Digital Liquidity Fund) which reached $500 million in assets in early July to become the largest tokenized fund in the world.

The total value of assets in tokenized funds has more than doubled since February to nearly reach $2 billion thanks to a new fund from BlackRock

That’s hugely impressive. Yet, for its progress, BUIDL—a play on the crypto phrase buidl to mean build—has just 18 holders, according to on-chain data.

That’s because BUIDL maintains the status quo by only being available to accredited investors or clients of brokerages or financial advisors. You can’t simply buy the token, unlike most cryptocurrencies. Potential investors must apply via Securitize—BUIDL’s Web3 partner—to gain access, before making a minimum investment of $5 million.

There are avenues to gain exposure via proxy. Some Web3 projects deployed portions of their treasury into BUIDL but that doesn’t provide direct yield to token holders. Ondo Finance, for example, became a major BUIDL backer when it moved an initial $95 million in March but it works with multiple funds and the proceeds go directly to a token that can only be held by accredited investors.

There’s increasing crossover between Web3 companies and traditional finance. Binance US recently gained approval to deposit an unspecified portion of its customer funds into US Treasury bills, conservative investment options run by the US Treasury Department.

US-based banks are somewhat hamstrung by investment regulations, which particularly limit products to accredited investors. There’s optimism that as digital products increase, so will opportunities for retail investors to access such higher end financial services.

3. The move to digital money

Funds are just one part of business where banks are looking to blockchain and digital technologies for inspiration.

JPMorgan and Goldman are among the banks that are using distributed ledger technology to process settlements and make international transfers. While Goldman has taken part in pilots alongside Visa, JPMorgan has an entire business—Onyx—that’s dedicated to moving money between organizations and across borders digitally, using blockchain as the ledger to track and account for the assets.

As digital asset transfers become more common for banks and financial institutions to move their money, it is easy to see how tokenization could be wholly adopted by other areas of their business function. For now, that has tended to be on a bank-by-bank basis but there’s another development that’s pushing digitization in a way that will encourage more banks to tokenize funds and other products.

Governments are increasingly investigating and testing central bank digital currencies (CBDCs) to tokenize and digitize money and simplify the art of moving, receiving and disposing money. It is easy to imagine a future in which your money is truly digital. Sure, today you can make a global payment using Wise or send money from Thailand to Singapore via a code scan but there’s cost and time required to process both.

In a world with broadly digitized money, the process is near-instant and potentially near-free. You could, for example, pull $5 from your Goldman Sachs fund to buy a (fancy) coffee on the way from work or automatically set your salary up to go pay your mortgage/rent, into savings and then to pay off your upcoming holiday.

Put simply: our consumption and demand went digital some time ago but the rails that power our money hasn’t yet.

The caveat to all of this is, however, that much of this will be centralized and not ‘free’ per the core tenants of Web3. But, as we have seen with Bitcoin ETFs, which fly in the face of what Bitcoin ‘should be,’ institutional adoption helps overall Web3 adoption.

News bytes

Ethereum ETFs went live in the US last Tuesday—the nine initial ETFs generated over $1 billion in trading volume on day one. That’s impressive but not expected to be as large as Bitcoin ETFs, which reached $4.6 billion in opening day trading volume.

WazirX, one of India’s top centralized crypto exchanges, lost more than $230 million following a hacker that’s thought to have been carried out by North Korean hackers

Igloo, the company behind popular NFT collection Pudgy Penguins, raised $11 million to develop a layer-two blockchain loosely aimed at onboarding ‘mainstream’ users

Ripple expects to resolve its years-long litigation with SEC soon, potentially within the next week according to reports—the firm was told to pay a $2 billion fine for selling unregistered securities through its token sale but it appealed

Bored Ape Yacht Club’s DAO is mulling a proposal to open a BAYC-themed hotel in Bangkok that would allow discount for holders of the project’s token—we wrote last year about the sometimes-zany initiatives that come out of DAOs to promote projects

CoinGecko’s report on the first half of 2024 shows memecoins, AI and real world assets (RWA) dominated crypto—topics we’ve covered in detail on this newsletter, too

That’s all for this week!

Share your feedback, questions or requests via email to: sowhat@terminal3.io