The SEC Just Flipped on Crypto: What It Means for Web3

Dropping 2-year-old Coinbase lawsuit signals a major shift in US crypto regulation

GM,

It’s been a huge week for Web3. Regulation of the industry has entered a new era after the US SEC dropped a range of actions against Coinbase, Kraken, Robinhood and other major crypto companies, undoing years of work from the previous administration.

It’s not uncommon for a new administration to reverse course, but the significance of these cases being dropped cannot be understated. Now, we finally get to see how the Trump administration plans to regulate Web3. There’s a lot to unpack!

Best,

PS: We are hiring for a range of roles at Terminal 3, check out the openings here

What’s going on?

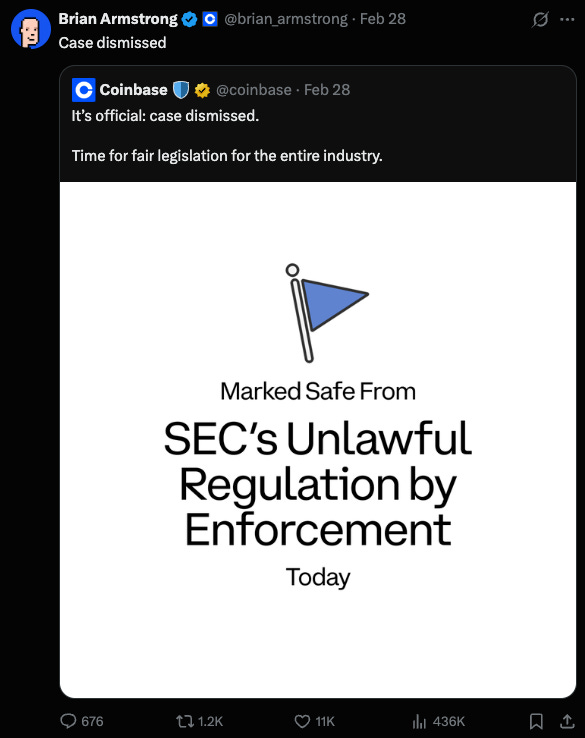

The SEC dropped its landmark lawsuit against Coinbase in a move that draws a clear line under the Gensler-led SEC and marks the start of a new era regulating digital assets.

The suit against Coinbase was significant. Coinbase is the highest-profile company in Web3 and the only one listed on a US stock exchange.

It often symbolizes the Web3 industry, and this attack on it certainly symbolized the Gensler-led SEC’s approach. Rather than seeking new laws, it used existing securities regulations; rather than working with the industry and its largest players, it went down a route of litigation, which lacked clarity and flexibility.

The SEC’s new approach throws all of that out of the window. This won’t be open season for Web3 but now there’s a chance for a new approach to regulate digital assets based on what they are, rather than applying a dated framework.

SO WHAT?

1. An end to regulation by litigation

The allegation from the SEC was that Coinbase’s core business was in breach of SEC laws, but other areas of the suit could have set regulatory precedence that would impact the entire industry and sway other governments.

In more detail, it alleged that:

- Coinbase acted as an unregistered exchange and broker

- Coinbase traded 13 “crypto asset securities”

- Coinbase illegally solicited new customers (comingling exchange, broker-dealer, and clearinghouse functions)

- Coinbase’s staking program was identified as an investment contract and as an unregistered security

The suit was filed in 2023 and it caused particular controversy because, just two years earlier, Coinbase got permission to go public on the NYSE. Nothing had changed since its IPO, so why suddenly was it not compliant?

Going after the only US publicly traded Web3 company in the industry, so dropping the case is equally as symbolic in paving the way for a new approach to regulation.

The SEC has formed a taskforce that will draft a new framework to analyse and regulate digital assets.

This regulatory pivot isn’t happening in isolation—Trump’s administration is doubling down on crypto in a way that was unthinkable a few years ago.

US policymakers have rejected a proposal to regulate DeFi using existing rules and President Trump continues to talk up the creation of a national crypto reserve fund, which he has now said will include Bitcoin, Ethereum, Ripple’s XRP, Solana and Cardano.

US states are already frontrunning that development by adding Bitcoin to their own reserve funds. Those are more likely to bear fruit before the federal government’s plan.

Such a development was unthinkable during the previous administration. Then, the regulatory landscape was such that US companies including Coinbase, Ripple and Gemini had considered building or moving core parts of their business overseas to more regulation-friendly jurisdictions.

The new approach is to build and grow on US soil, and that’s a remarkable change.

2. A green light

The news headlines are around Coinbase, and it was the main target, but it was far from the lone case.

The SEC served Well Notices—correspondence that confirms the recipient is being investigated by the commission—to at least half a dozen other prominent businesses in a sign that it was looking at the whole industry in detail.

Just as the Coinbase suit has been dropped, so early-stage investigations with the following companies have ceased, too:

- Kraken

- Robinhood

- Gemini

- Uniswap

- OpenSea

- Metamask (via parent company Consensys)

- TRON

- Yuga Labs (which owns Bored Ape Yacht Club)

In the case of TRON, both parties are exploring a settlement in a civil fraud case against its founder, Justin Sun—who serves as an advisor to President Trump. The situation looked bleak for Sun, who faced charges around illegally distributed crypto assets, inflating trading volumes and secretly paying for celebrity endorsements.

It was an open-and-shut case. The fact that it is being settled suggested more clearly than anything that the SEC is moving on and abandoning all previous approaches.

Over the last week, the SEC even came out with a comment which suggested that memecoins may not fall under its regulatory jurisdiction.

These changes have prompted companies to reintroduce services in the US that had been suspended given the uncertainty of the Gensler-era commission. Uphold, a smaller rival to Coinbase, moved fast to reintroduce staking in the US this week and you’d expect others will do the same.

3. A more promising future

The situation isn’t all rosy for the industry right now with current market prices down from previous highs in December.

Sentiment among founders, investors and others in the industry that we at SO WHAT speak to on a regular basis isn’t high.

Project founders are unsure whether to launch tokens, with mainnet announcements continually pushed back or canceled altogether. Investors spent last year enjoying a buoyant market but have been somewhat cautious in 2025 so far. The memecoin market has dropped significantly since December and January, and trader sentiment on social media is that ‘the top’ was in and it is downhill now.

Yet the SEC has made the kind of moves that the industry could only have dreamed of over the last few years. And it has made them very publicly and clearly.

For the first time, the US market doesn’t need to intimidate Web3 companies, and those building Web3 businesses on US soil don’t need to look overseas to figure out where they should move to continue running their company.

Indeed, other countries are paying close attention to America’s new approach to digital assets. India has traditionally been one of the most conservative countries when it comes to cryptocurrencies, but it has said publicly that it is reevaluating its stance. Hong Kong, meanwhile, has doubled down on its efforts to become a global Web3 hub.

Regulation is unlikely to make the US a Web3 haven in which anything goes. There will still be restrictions. But increasingly it looks like the framework will be made in consultation with the industry and with the goal of harnessing the valuation that its technology can bring: be that decentralized networks, tokenization, cross-border payments or DeFi yields.

Regulation won’t turn the US into a free-for-all, but for the first time, the industry has a real chance to build on home soil—with clarity. That’s more valuable than any price pump.

News bytes

The North Korean hackers who stole $1.5 billion from Bybit have laundered the full amount using Thorchain—which earned $5.5 million in handling fee

Binance will delist Tether’s USDT from a range of EEA countries (in Europe) because the stablecoin does not comply with the region’s Markets in Crypto Assets Regulation (MiCA)

Crypto.com affiliated blockchain Cronos announced a controversial proposal to reissue 70 billion CRO tokens, which were originally burnt in 2021 and are worth just under $5 billion at today’s price

Top Ethereum Web3 wallet Metamask is adding support for Bitcoin and Solana in a signal that their ecosystems are developed significantly over the last year

Franklin Templeton filed for the Solana ETF which could break ground by giving investors not only access to Solana as an asset, but also staking rewards—staking has been absent from other crypto-themed ETFs to date

That’s all for this week!

Share your feedback, questions or requests via email to: sowhat@terminal3.io