The rise, fall and recovery of Solana—the original alternative to Ethereum

This week we begin a new series looking at Solana, a blockchain firm that might just be the most interesting company in Web3.

That’s a bold statement to make but there’s so much about Solana that captures the rollercoaster-like nature of Web3 over the last few years. From a very understated beginning that spawned a new category of companies; to crazy highs—and 12,000% gains in a year—and gutter-like lows as the crash of FTX, a close partner, hit hard.

This week we look at its boom, bust and recovery cycle. Next week, we’ll assess what the future holds for Solana.

Best,

What’s going on?

Web3 is all about alliances, and Solana’s close relationship with the founder of a major crypto exchange was one of the best ways to gain visibility—until recently.

Solana was just another blockchain when it launched to little fanfare in March 2020—but a year later it was the talk of Web3, with blazing fast speeds dividing critics who disliked its more centralized approach. The backing of Sam Bankman Fried, then a showy, young crypto founder bankrolling politicians and flexing muscles of influence, gave Solana a narrative to reach startup founders and retail investors.

So how did the project survive when its biggest hype man ended up in court for fraud and other serious charges?

SO WHAT?

1. The first Silicon Valley Web3 giant

Until Solana burst onto the scene, there was no major Web3 presence in Silicon Valley.

The scammy-nature of the ICO boom—overly-ambitious projects raising tens of millions of dollars based on sheer speculation—felt at odds with Silicon Valley’s focus on building technology. When the Ethereum foundation, and its founder Vitalik Buterin, began to spend time in California discussing the benefits of decentralization on the internet, Silicon Valley began to wake up to Web3. But it took a feline breeding crisis for things to really happen.

In 2018, two co-founders created Solana: Anatoly Yakovenko, a former engineer with Qualcomm who had worked at Dropbox among other places, and Raj Gokal, a serial entrepreneur focused on health tech.

Their trigger was an Ethereum-based game called Crypto Kitties that let users breed different types of cats to create NFTs that often changed hands for vast amounts. Web3’s first true game, the cute title was also an important milestone. In late 2017, it caused never-before-seen levels of activity on the Ethereum blockchain, which clogged the network and made it difficult for anyone to use it to process transactions at all.

That’s when Yakovenko, a distributed systems specialist, conceived a different type of blockchain to Ethereum: Solana. Solana claims to be able to process 65,000 transactions per second (tps), Ethereum, meanwhile, was then stuck at 30 TPS until a major upgrade in 2022 raised its future capacity to 100,000.

Despite its promise, it wasn’t until the summer of 2021, that the one-year old Solana Network began to take off. Solana’s SOL token started the year at $1.5, but a surge took it to $210 by September as the narrative around its speedier network grabbed attention from institutional investors—a number of whom invested $314 million in June 2021.

2. FTX and rocket ship growth

Yakovenko’s focus on building a fast network with lower gas fees required to complete transactions was music to the ears of Bankman Fried, then helming one of the world’s most influential exchanges, FTX.

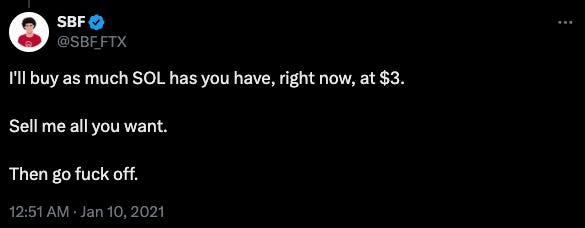

A self-confessed Solana fanboy, Bankman Fried created a decentralized exchange in 2020 called Serum that was based on the Solana Network. But he was banging the SOL drum long before. In a January 2021 tweet that went viral, Bankman Fried argued with a high-profile trader who criticized Solana’s technical merits. The exchange illustrated his confidence and, given his profile at the time, appeared to anoint Solana as a Web3 firm to watch.

Perhaps it was the opportunity to be the face of an emerging Web3 brand and trading token—the way Buterin represents Ethereum—but, all the same, FTX and Solana became closely intertwined. Media coverage of Solana was often coupled with mentions of Bankman Fried, who would wax lyrical over Solana’s advantages.

The relationship wasn’t just one way, though. The Solana Foundation owned FTX shares, FTX’s FTT tokens, tokens for Serum and more than $1 million on FTX the trading platform, but that is said to be less than 1% of its assets.

3. When Winter came

When the market was good, close alignment to FTX was advantageous. When the market collapsed as FTX’s theft of customer funds was exposed, it became an existential threat.

Not only was Bankman Fried a key ally for Solana, but FTX and its sibling company Alameda Research were major stakeholders. The firms had bought nearly $1 billion worth of SOL between them, which was locked and not tradable for a number of years.

The price of SOL already collapsed in line with the wider market following the implosion of both Three Arrows Capital and Luna in 2022, but when FTX fell apart, SOL went below $10 for the first time that breakout summer. Many believed Solana’s star would fade with FTX.

That hasn’t been the case, however.

Last year, Solana inked deals to add support for its network to Visa and payment processor WorldPay, while it also ventured into the world of smartphones with Solana Saga (below). The phone was panned by critics as gimmicky, but a second version has seen strong pre-sale interest and no other Web3 firm is doing as much on mobile.

More broadly, though, Solana’s enduring survival comes down to adoption. It has a reasonable $4.5 billion locked in DeFi services (around 2.5% of all Web3 DeFi) but it continues to attract tens of thousands of Web3 companies thanks to the faster and cheap transactions it burst on the scene offering—and despite a handful of hours-long outages in recent years.

Today, Solana is established as one of the top alternatives to Ethereum, the blockchain that ushered in Web3. It continues to be criticized for allegedly lacking the same decentralization and its occasional outages, but its community building new projects—including memecoins—and its continued pursuit of areas like smartphones, it continues to work to define the bounds of the Web3 industry.

We will return next week with a look at what to expect from Solana in the future—don’t miss it!

News Bytes

A US court ruled that trading of certain crypto assets on a secondary market, such as Coinbase, are securities transactions

Hong Kong will soon introduce a regulatory sandbox to enable stablecoin issuers to test business models, products and more, according to financial secretary Paul Chan

The Nigerian government has demanded a massive $10 billion from Binance after it accused the company of manipulating foreign exchange rates and moving some $26 billion in untraceable funds—the Nigerian Naira has lost nearly 70% of its value in recent months

There’s good news and bad news for FTX customers—those who lost assets when the exchange imploded can lodge a claim to return them, but only at then-market rates which are far lower than current crypto prices

Bitcoin is rallying towards a new all-time-high as we write this newsletter—continuing its impressive performance from last year. Already it has broken records against the Euro and British Pound—US Dollar is next…

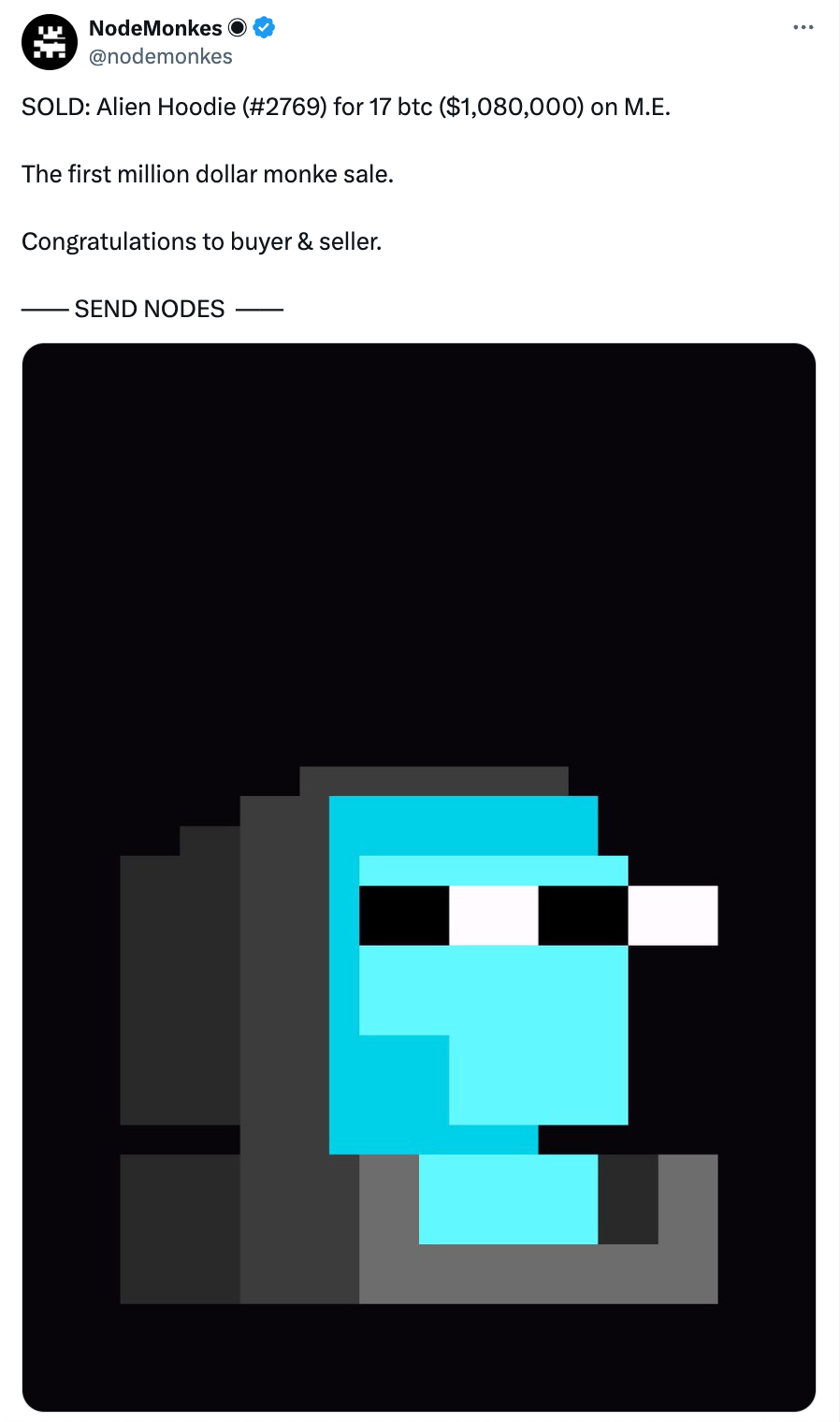

Also in Bitcoin-land, the NFT market for BTC is charging with Bitcoin-based NFTs out-trading those of Ethereum. Notably, Bitcoin-based NFT collection NodeMonkes saw its first $1 million sale—that’s based on Bitcoin Ordinals, the controversial project to “make Bitcoin fun again”

That’s all for this week!

Share your feedback, questions or requests via email to: sowhat@terminal3.io