Telegram’s aborted blockchain project came back from the dead and is now the hottest platform in Web3

GM,

Web3 is all about taking unfair advantages. Last week, we looked at how Coinbase used its position as an industry bellwether and public company to develop the second largest Ethereum layer-two platform in less than a year.

On a related theme, today we are diving into TON, the blockchain and token that’s linked to messaging app Telegram, which claims 900 million users.

The project was shut down four years ago due to legal concerns following a lawsuit from the US SEC, but now the project is beginning to deliver on its promise with a wallet integrated with Telegram and other services.

The price of TON has tripled this year, sending it into the top 10 blockchain based on total value. That link to a prominent and thriving app makes TON a unique proposition, and certainly a blockchain project worth understanding in more detail—let’s get into it.

Best,

What’s going on?

TON, The Open Network, is on fire right now. A number of games have emerged from the platform this year, showcasing its potential to become a platform with genuine consumer adoption thanks to its links with Telegram. That’s helped push the value of the TON token to an all-time-high this month, putting it into the top 10 blockchains based on total value.

Price aside, the industry is excited about TON for its potential to reach a genuinely sizable audience of consumers in a way that no other Web3 projects have been able to so far. Telegram has 900 million active users and already many of them interact with TON through features that include its integrated wallet, peer-to-peer token transfers, games and more.

TON has existed fairly independently of Telegram but, with the two entities working more closely together over the last year, the project has gained the attention of developers who see it—and Telegram—as an avenue to reaching users that exist outside of the crypto bubble.

But the TON journey hasn’t always been simple.

SO WHAT?

1. Billions of dollars and legal struggles

TON was originally conceived by Telegram, which named it the Telegram Open Network.

The TON whitepaper was developed in 2018 in response to the Telegram team being unsatisfied with the blockchain options in the market. That blueprint—which essentially involved taking on Ethereum—raised $1.2 billion from investors, a colossal amount of funding at any time especially then.

Ultimately, though, Telegram was forced to return the capital following a lawsuit from the US SEC which accused the company of selling securities. Telegram settled the dispute in June 2020 and dissolved the TON effort. That appeared to be it, but in 2021 TON was picked up by community members who formed the TON Foundation independently of Telegram and renamed the token from Gram to Toncoin, under the ticker TON.

Building on the foundations developed by the Telegram team, including founder Pavel Durov, the new foundation and project continued to chase the goal of becoming a fast blockchain that could handle significant transaction volume without requiring significant gas fees: the two issues Telegram found when it analyzed its options years prior.

At the end of 2021, TON progressed to the point that it drew praise from Durov who said it could become “something epic.” That moment marked a change as the independent Ton began to explore opportunities to integrate directly with Telegram to benefit both services.

2. Quietly tapping into Telegram

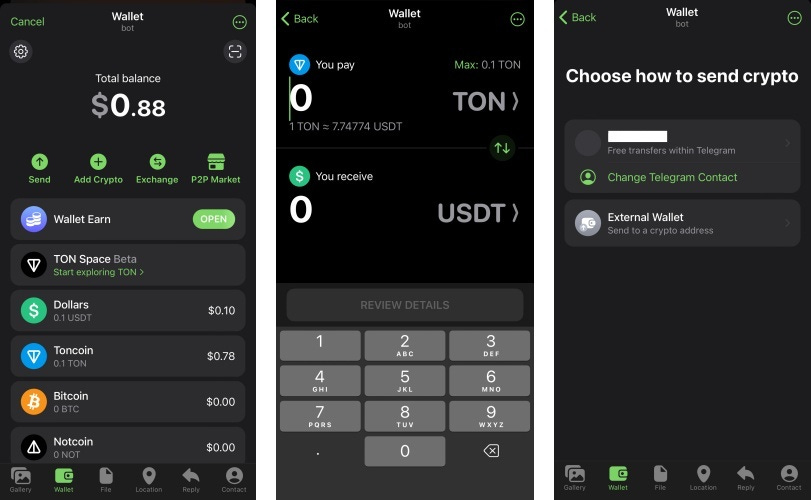

Despite a difficult journey, the two sides united last September when Telegram endorsed TON as its “official Web3 infrastructure.” The two companies remain separate and independent but their new-found partnership began with the integration of a TON-based wallet which allowed users to buy, hold and transfer tokens to other users from inside the messaging app, using a model first popularized by WeChat, China’s top messaging app.

The integration inside Telegram is subtle. Telegram isn’t ramming Web3 in the faces of its users, but the wallet setting can be found inside the app for those who are curious.

With that key piece in place, Telegram has gone on to add other TON-related features that include digital asset trading, NFT marketplaces and tradeable usernames. It recently began to allow users to buy Telegram advertising using TON and, most importantly, it enabled TON-powered mini games—another WeChat-like creation—to exist within Telegram, too.

These games are basic, but they’ve proven popular. Notcoin, a game in which users earn coins by tapping a target on a screen, claims to have attracted upwards of 60 million users. Launched in May 20204, it used gamification tactics, including incentives for inviting friends and creating teams as well as hints at a future token, to quickly reach that impressive number.

That 60 million number may be registered players rather than active ones, but the active numbers are impressive. The project has 1.7 million Twitter followers, over 2 million wallets holding its token and 8 million subscribers to its Telegram group. For context, Axie Infinity—crypto’s most successful game—claimed to have reached 2.7 million daily users during the bull market of 2021.

If a simple game like Notcoin can garner that level of attention during less frothy times, it is easy to see why developers of more sophisticated apps and services are excited at the potential that Telegram and TON could offer.

3. An avenue to reaching mainstream users

WeChat has long served as inspiration for messaging apps worldwide, but few have managed anything like the success of the Tencent-owned chat app. A lot of that is to do with the uniqueness of China’s internet landscape—which didn’t have dominant social media companies like Facebook or Instagram when WeChat began to gain momentum in the previous decade.

Telegram has some things in common with WeChat. It is less popular than Meta’s WhatsApp or Messenger apps which claim over 2 billion monthly users, but Telegram has a very loyal following among Web3. It is the de facto messenger for the industry, replacing business cards and email for many.

That captive audience means the wallet feature and even the concept of a token accompanying the product, has a chance of finding significant traction. It is still very much early days, but if Telegram follows the WeChat model then it is likely to lean heavily on enabling the finance and payment side of services—likely adding more wallets and transactions—as well as more gaming and basic services. In WeChat’s ecosystem, that meant services like ride-hailing, bike-sharing and basic shopping. Right now, those aren’t options for Telegram since there aren’t strong Web3 services in those spaces. But the TON Foundation has spent the last year or so building relationships with developers through hackathons, events and more as it looks to encourage new services to emerge on its platform.

That’s ultimately what TON traders, developers and others within the ecosystem are betting on. If the sophistication of decentralized apps (dapps) and Web3 services can accelerate, Telegram could create a blossoming ecosystem with TON that is genuinely different from other chat apps. For now, the TON integration is a cool feature within Telegram that is of interest to a minority of users.

But that potential alone is making TON stand out from the crowd and offer a very different opportunity within Web3.

News bytes

Terraform Labs, the company behind disgraced crypto products Terra and Luna, reached a $4.47 billion civil settlement with the SEC after being found liable by a jury for defrauding investors who lost an estimated $40 billion when they collapsed in 2022

MicroStrategy, the fund that’s famous for owning 1% of all Bitcoin, is raising at least $500 million to buy yet more Bitcoin

The Biden campaign will soon accept donations via cryptocurrency following the Trump campaign’s lead

El Salvador may set up private investment banks that give Bitcoin investors access to financial services and fewer restrictions compared to traditional banks

Long-standing Web3-focused VC Paradigm announced its third fund, which is $850 million

SEC Chairman Gary Gensler has reportedly said that Ethereum spot ETFs should be approved by “the end of the summer”

That’s all for this week!

Share your feedback, questions or requests via email to: sowhat@terminal3.io