Telegram is essentially a Web3 company now

GM,

Telegram CEO Pavel Durov’s arrest on August 24 in France has sparked major discussions across the Web3 space.

Governments across the world have raised their focus on Telegram and Durov, predominantly on the impact of its lack of content moderation, and the debate between privacy and anonymity. While much has been said about the arrest, the release of Telegram's financials reveals another intriguing story: the growing role of Web3 in its business model.

It’s a unique model and worthy of our attention—let’s get into it.

Best,

What’s going on?

Telegram Open Network, known as TON, is the hottest platform in Web3 right now, as we noted back in June.

In June, the platform crossed 570,000 wallets. By August, that number surged past 1 million, driven by the rise of mini apps within Telegram. Mini apps—apps within apps—are on the rise because they help developers reach Telegram’s 900 million monthly active users easily. Crucially, many are tied to TON, the cryptocurrency.

Following Durov’s arrest, newly surfaced Telegram filings reveal that TON is more than just a crypto experiment—it’s now a crucial pillar of the company’s future. It could also have a bearing on how other messaging apps tap Web3 to build sustainable businesses.

Cryptocurrency doesn’t sound like the basis of anything stable, let alone business models, but let’s dive into why that is the case for Telegram.

SO WHAT?

1. How to monetize messaging?

Messaging apps grew like weeds over the last decade or so, particularly in Asia where WeChat, Line, Kakao and others beat out Facebook Messenger, WhatsApp and other global platforms in their local markets.

Attracting and retaining users was one thing, but turning popularity into revenue is notoriously tough with chat. People want to chat with their friends, not be bombarded with ads or distractions.

Messenger, WhatsApp and Instagram Direct Messages—a chat platform in its own right—don’t make money on their own, they plug back into social networks which monetize via advertising. That made it next to impossible for standalone chat apps to make money.

Asian messaging apps discovered that building out an ecosystem of services could make money. WeChat embodied that push. Parent company Tencent doesn’t break out WeChat’s revenue, but estimates suggest its mini programs generated $247 billion in GMV (total sales for all partners) back in 2020, while WeChat Pay processes billions of transactions daily.

Line in Japan and Kakao in Korea took a similar path albeit with more modest results based on enabling services like taxis, shopping, games, sticker sales and more.

Telegram, though, has a trickier path as a more direct WhatsApp competitor that lacks both Facebook’s money-making muscle and the local focus to support a constellation of services as messaging apps in Asia do.

Durov has never publicly worried about that. He has raised billions in capital since Telegram’s launch in 2013, including a fresh $330 million in March and $210 million last year. It increasingly appears that Web3 is Telegram’s long-term solution… or rather the bet it is making.

2. Crypto is how Telegram makes and retains money

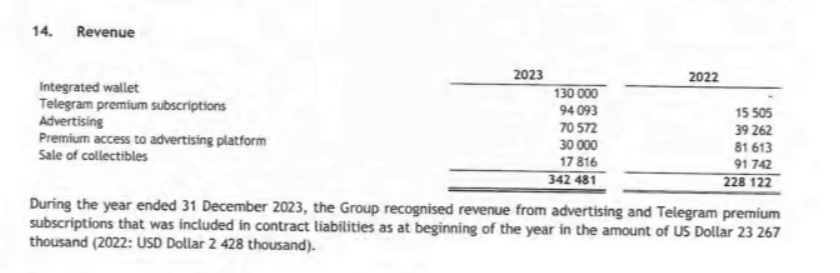

According to the Financial Times, Telegram’s latest financial filings, submitted annually in the UAE where the company is based, show that Web3 is now critical to its revenue.

The upshot is that 40% of Telegram’s revenue comes from Web3: the integrated TON wallet and the sale of digital collectibles, which includes NFTs for user IDs and more. Advertising and premium services can also be paid for in TON as well as regular fiat currency.

In fact, digital assets like TON now account for $400 million on Telegram’s balance sheet—more than its cash holdings.

This is where TON is a crucial piece of the puzzle.

A large amount of TON coins came from Telegram’s agreement to integrate a TON wallet. Since TON is developed independently of Telegram, it received 285 million TON coins through its agreement. With an average value of around $2, that deal alone was worth north of $500 million last year.

Telegram disclosed in its financials that it netted $243,505 from selling a portion of those tokens. But whatever it has left will be worth significantly more in real-world money terms given that TON’s price is now over $5. Unfortunately, because the report is accurate to 31 December 2023, we don’t know the size of its current treasury and digital asset holdings.

But even without absolute numbers, the gist is clear: digital assets are a key part of how Telegram makes money and a critical part of the assets it has on its balance sheet.

3. Messaging platforms are following suit

In our previous story we noted that Telegram’s integration of TON was an advantage for both sides because it enabled (a) developers building on TON to reach Telegram’s 900 million active users and (b) differentiated the user experience on TON by adding crypto-centric features for those who want them.

This combination is now showing significant financial gains for Telegram so it is no surprise that other messaging platforms are dipping their toes into the water.

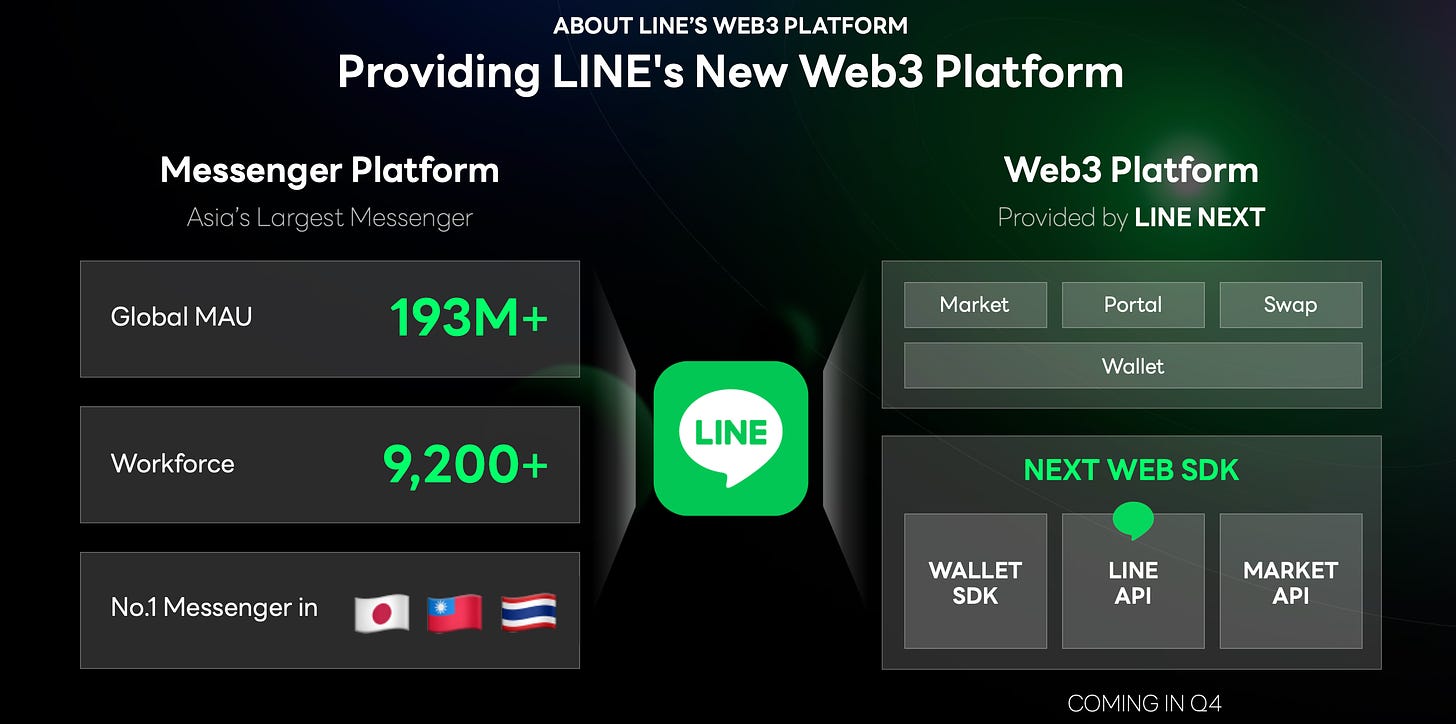

Kaia is emerging as a chain that’s looking to follow in TON’s footsteps. It has the pedigree, having been formed by a merger between Kakao’s Klaytn blockchain and LINE’s Finschia platforms in April.

Kaia launched mainnet, a full launch that includes a token launch, grants for developers building on the platform and rewards for early users. The real carrot here is the combined 250 million active users on Kakao and Line combined, which claim dominance in key Asian markets Korea, Japan, Taiwan and Thailand.

It is taking a leaf out of the Telegram playbook with a software development kit (SDK) that will allow developers to build mini apps for Line and presumably Kakao later, too. With the addition of potential grants of $1.2 million for developers, Kaia could have a shot at replicating Telegram’s success at a smaller scale.

Despite its progress, Telegram booked an annual loss of $108 million despite generating an impressive $342.5 million in revenue. Its crypto experiment has graduated from experiment to core pillar of its business but it remains to be seen if that engine is powerful or reliable enough to take the company to the IPO that Durov seeks, and at his lofty target of a $30 billion valuation.

Telegram’s path to a public listing remains uncertain, especially as Durov faces legal challenges in France. Despite the significant concern in content around the platform, Telegram has built itself a unique business which stands out as remarkable compared to its more conventional peers.

News bytes

DeFi protocol Penpie lost $27 million following a hack, however Pendle—the platform it is deployed on—paused its smart contracts in a move that it claims safeguarded $105 million in funds that would have been snatched

The Verge has an insightful longread on the rise and fall of NFT platform Opensea, which was once valued at $13.3 billion but has suffered as the market for NFTs has deflated

It emerged that Opensea received a Wells notice from the SEC, a sign that the agency is probing either the NFT space, Opensea’s business or both—potentially it is looking into whether NFTs are securities or not

Coinbase is claiming a breakthrough after it carried out the first AI to AI crypto transaction, an event it believes will foreshadow future transactions and AI use cases

The US Federal Reserve issued a cease and desist order to United Texas Bank on account of alleged deficiencies in the bank's risk management systems, particularly in its dealings with crypto clients

US Presidential candidate Kamala Harris has followed Donald Trump and is now accepting cryptocurrency donations for her campaign

That’s all for this week!

Share your feedback, questions or requests via email to: sowhat@terminal3.io