Starbucks’ voyage into Web3 loyalty is over—but not because of NFTs

GM,

Starbucks became the biggest global brand to dive into NFTs when it announced a Web3 loyalty program called Odyssey in September 2022. But that voyage of discovery comes to an end this week after the coffee giant abruptly announced its closure after less than 18 months.

Odyssey was widely-heralded by the Web3 community as a sign that brands would dive into loyalty and branded NFTs and tokens. Does its shuttering mean that won’t happen? Not exactly—there’s plenty for us to learn as we explore in today’s newsletter.

Best,

What’s going on?

Starbucks grossed $36 billion in revenue in its most recent financial year. It is truly a juggernaut. But it has transcended from a business into a brand—with 4% of sales from non-coffee and food products. Customers don’t just drink Starbucks coffee, they want to buy its mugs, collect points to get its bags and even visit its coffee farms when they go on vacation.

The Starbucks mobile app is well established having launched more than 10 years ago. It lets users load a prepaid balance, make orders (mobile accounts for 30% of US-based orders) and it connects them to the Starbucks loyalty program, which counts 35 million active members in the US alone.

Those are incredible numbers. But Starbucks didn’t truly tap into that deep business with Odyssey and that is ultimately why it is canning the project. The company hasn’t explained why, but we read the tea leaves to reach three key conclusions.

SO WHAT?

1. Limited and confusing

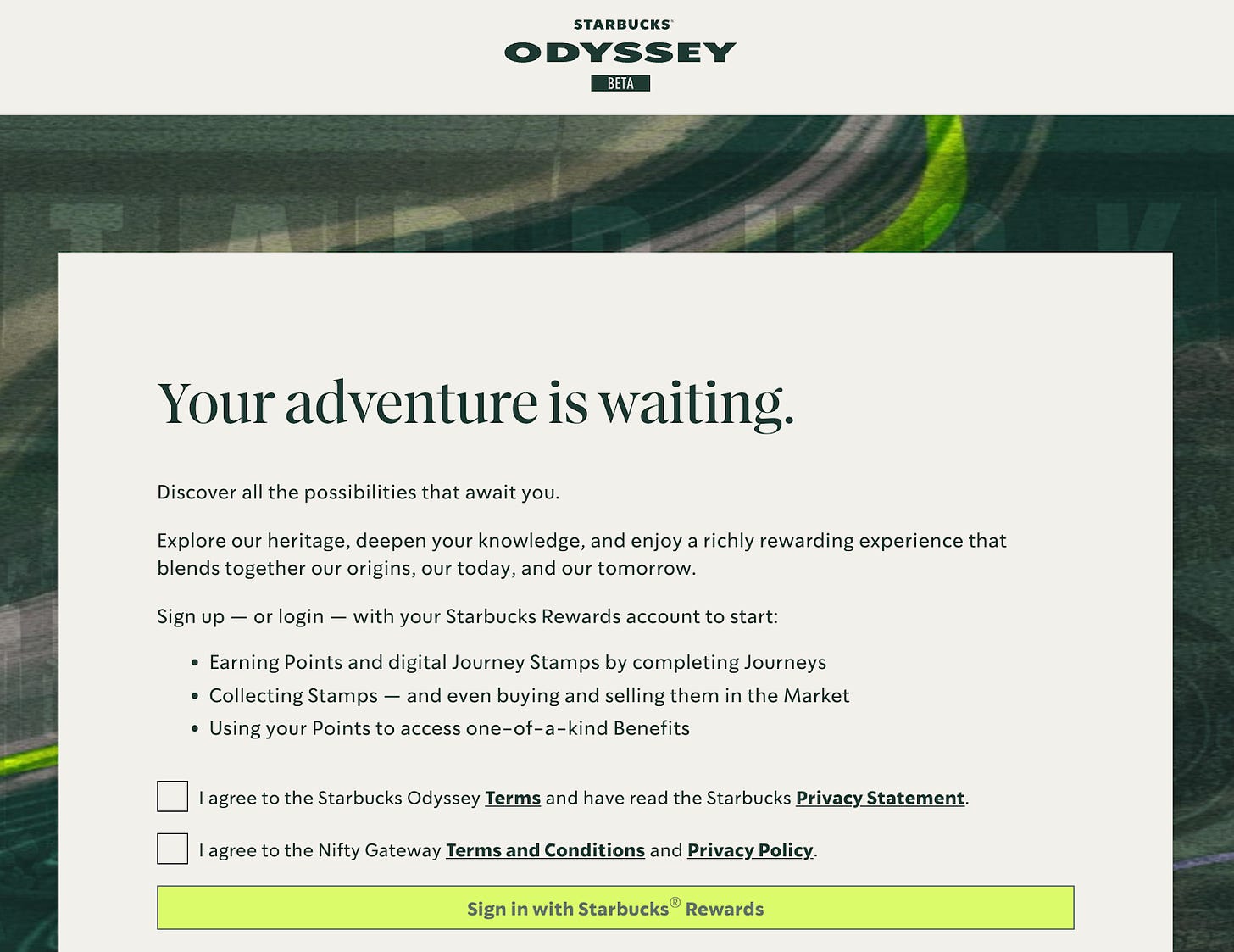

Starbucks jumped into Web3 with two experienced partners: infrastructure firm Polygon and NFT store Nifty Gateway, which is owned by Gemini, the exchange run by the Winklevoss twins.

Importantly, the project was marketed as an extension to the existing loyalty program not a replacement or long-term successor. It was also invite-only rather than open to all members.

Users could earn points through interactive ‘Journeys,’ collect stamps that could be redeemed for “one-of-a-kind” benefits or traded on the Nifty Gate exchange. The system was tiered based on points earned or acquired, a fact that confused and irked some members who couldn’t access the program or reach the top tier without buying NFTs. That is, if they were invited to join the Odyssey program.

Still, the early signs were positive. Its first paid mint—an NFT collection released for sale—in March 2023 sold all 2,000 pieces in less than 20 minutes. The NFTs were selling on the secondary market at over $500, far above the $100 mint price. Other NFTs earned by users for free had sold for as much as $1,500.

But with the NFT points benefits limited to those who had been invited to Odyssey, its appeal was unclear and a second paid collection failed to sell out just one month later. Starbucks publicly backed the project but it stopped selling new collections as the NFT market saw a downturn.

2. Not widely marketed

Chiefly, Starbucks looks guilty of failing to push Odyssey strongly. The program was available only in the US, but it was limited. Customers complained on Reddit that they were ineligible—even some who were emailed with an invite weren’t able to join.

More than that, Odyssey wasn’t pushed hard within Starbucks’ own real estate. There was no fanfare within the Starbucks mobile app and, according to Coindesk, even US retail stores did not contain marketing or advertising for the program. Notably, it remained in ‘beta’ for its entire, short life. While it is not uncommon to test innovative ideas or approaches on smaller subsets of users, Odyssey likely reached only a miniscule number of Starbucks customers.

If the program was designed to capture the fanatical customer, who buys Christmas-themed mugs and carries Starbucks branded tote bags, this lack of marketing push and severely restricted access made that challenge nigh impossible. It was smart to make Odyssey an extension of the Starbucks reward program because it had the capacity to confuse many customers—rewards programs are, after all, hugely valuable—but it came across as a niche within a niche.

3. Not representative of the potential

One of the more eye-catching details to emerge from the shuttering of Odyssey is that Polygon paid Starbucks a reported $4 million to host the program.

That runs contrary to how technology projects typically work. The customer will usually pay the vendor to set up and operate a service. But this is Web3, where many companies are awash with funds and looking for use-cases, particularly in the real world, for their technology. It is very possible that paying a leading brand to operate a Web3 program could end up reaping financial benefits for a Web3 company. Not only might other brands follow suit, but the Web3 company’s token price could rise based on the news that it has found ‘real world adoption.’

Still, Coindesk reported that Starbucks wasn’t just in it for the money, it had spoken to other Web3 companies and ultimately picked Polygon.

It isn’t just about NFTs, though. It is hard for any established brand to simply bolt new technology into their business without hiccups. There are existing examples of how it can be done with NFTs. Reddit, for instance, introduced NFTs to its users in a way that is additive to their experience, as we wrote last year. It has sold more than 20 million by making it an experience that any user can go through, with the Web3 tech sitting in the background—and it, like Starbucks, partnered with Polygon.

Starbucks Odyssey will come into port permanently at the end of this month, but there’s plenty to learn and get excited about for other brands in the future. It’s a shame that a powerful and recognizable brand like Starbucks didn’t push its Web program harder and make it more transparent—but then disrupting a successful business is never going to be easy.

News bytes

Sam Bankman-Fried, the founder of bankrupted crypto exchange FTX, was sentenced to 25 years in jail after being found guilty of stealing billions of dollars from customers

KuCoin, another exchange, and its founders face criminal charges in the US over alleged money-laundering violations

A US judge ruled that the SEC’s claim that Coinbase engaged in unregistered sales of securities will be heard by a jury at trial—Coinbase said it expected the ruling but it could have major consequences not just for Coinbase but which, and whether, cryptocurrencies are defined as securities

Elsewhere, the SEC plans will ask a New York judge to fine crypto firm Ripple $2 billion—its case against Ripple began in 2020

Despite the possiblity that Ethereum could be declared a security, BlackRock CEO Larry Fink still believes the US could allow Ethereum ETFs

HSBC launched a tokenized gold product in Hong Kong that it claims is the world’s first blockchain-based real-world asset that’s available to retail investors

That’s all for this week!

Share your feedback, questions or requests via email to: sowhat@terminal3.io