Real World Assets are a buzzword but also Web3’s trillion-dollar opportunity

GM,

Welcome back to SO WHAT and the latest in our series of deep dives into how the Web3 space is maturing in 2024. This week we are focusing on Real World Assets (RWA), a buzzy phrase that essentially describes the concept of tokenizing… real world things. That ranges from real estate, artwork and cars to loyalty programs, financial products and more.

This edition is a little heavy on financial products, to give a disclaimer, but this is a very key and emerging segment so you’ll want to know what’s happening.

To recap, last week we looked at the timely arrival of Bitcoin ETFs in the US, how their arrival may impact Bitcoin’s pricing in the long-term and the irony that buying Bitcoin from a financial giant like BlackRock goes against the very genesis of the cryptocurrency. Now we’re looking at how Web3 can democratize institutional products.

Best,

What’s going on?

$16 TRILLION. That’s a forecast for the total value of RWA worldwide by 2030, according to Boston Consulting. It’s also the kind of number that explains why the Web3 industry is rightly excited by its potential.

There is disagreement on the exact number—some argue it is too conservative—but there seems to be consensus that RWA is a huge opportunity waiting to be tapped. The reason is simple: there are trillions of dollars of assets that don’t have real-time tradeable liquidity. That can change if they’re tokenized—a process that involves creating a token to divide the value of the asset and make it tradeable, using a blockchain to record current and past ownership.

The forecasts are varied because the potential of RWA is as broad as the asset types that can be tokenized. But all predictions are in the trillions of dollars. That’s why you NEED to care.

SO WHAT?

1. The trillion-dollar opportunity

Anything that has value and limited liquidity is a potential market for tokenization. One seachange that the growth of Web3—and in particular cryptocurrencies—has ushered in is real-time 24/7 trading. That has presented challenges, right from regular down to even the business of journalism, but it has changed the ways assets can trade: any time, any place and by anyone.

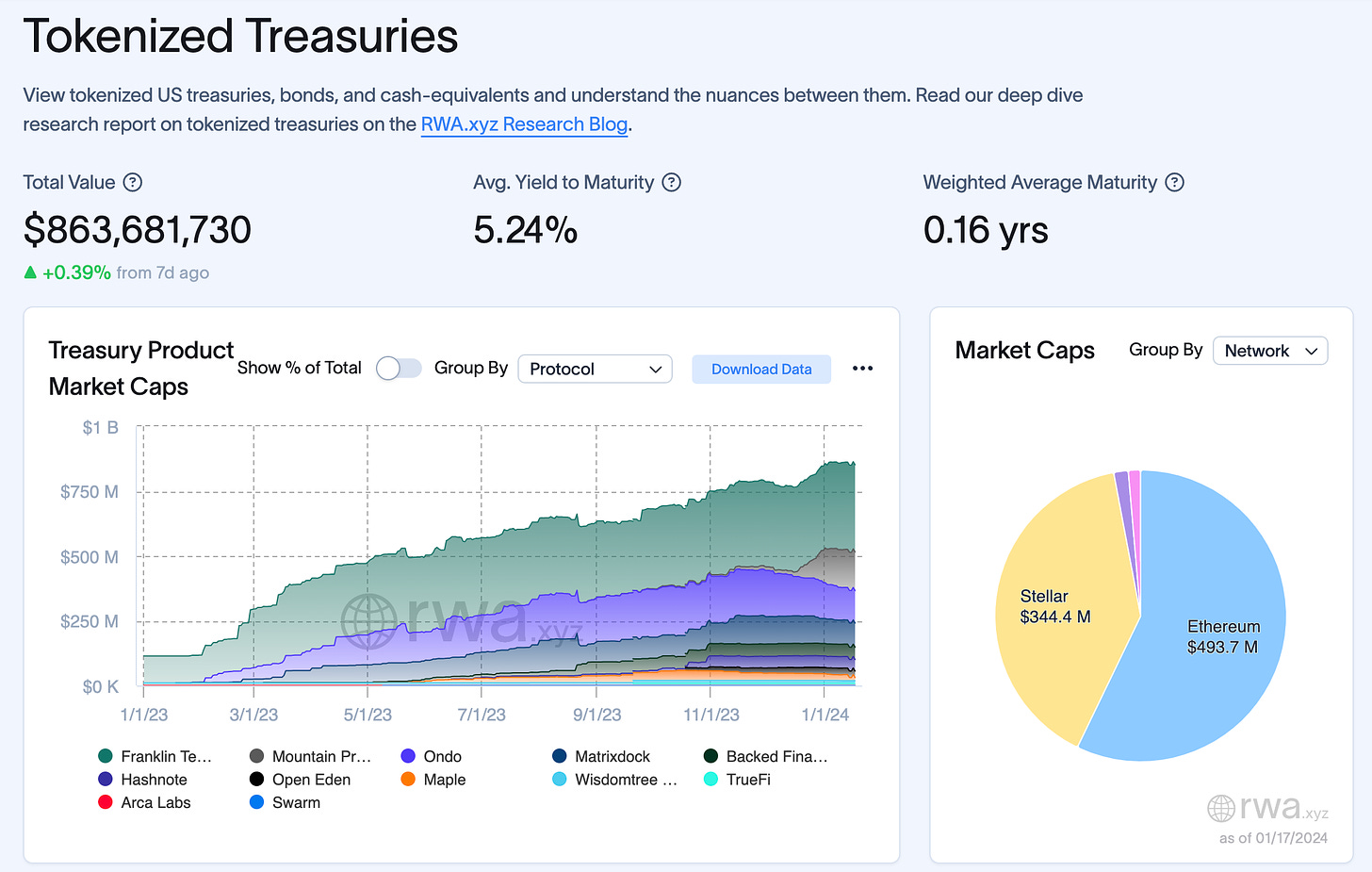

Bitcoin ETFs put a new asset into an existing trading framework, but the bigger opportunity is to go the other way. RWA companies are creating a brand new framework to trade existing assets. Products that tokenize US treasury bills (T-bills) grew by over 600% last year to surpass $700 million. Startups including Ondo Finance, backed by Tiger Global and Peter Thiel’s Founders Fund, tokenize US–based securities to allow them to trade anytime and from any country.

But it isn’t just about financial products. Expensive artwork that typically sits in a vault collecting dust in between infrequent sales could become a yield-generating asset via fractional sales. Young people find it hard to buy a first property and thus rent, but fractional ownership could enable them to invest for exposure to real estate growth. There’s also opportunity in providing lending and working capital, to name just one other.

2. What will it take?

Still, considerable development must happen on the regulatory side for RWA to go beyond its current offerings and fulfill more of that multi-trillion dollar potential.

Products connect assets to tokens—to enable retail investors to own and trade—but the legality of tokens remains unclear in numerous key markets, chiefly the US. That’s still in process in the US—we wrote back in July that a series of lawsuits could define whether cryptocurrencies can be sold legally—and that’s a key stumbling block if retail investors are to be involved.

Other challenges remain, including establishing direct and legally-robust links between tokens and the assets they represent. RWA projects in areas like real estate have struggled to do so, with a network of companies used to connect value, raising questions of what might happen in worst case scenarios.

Ultimately, the tokens will likely be regulated as securities—since there’s an inherent expectation of financial returns—with KYC requirements, but they will need additional infrastructure such as indices, data availability nodes and more. But these types of infrastructure are now being built, and their increasing availability could enable even more derivative financial products to be created.

3. A glimpse into the future

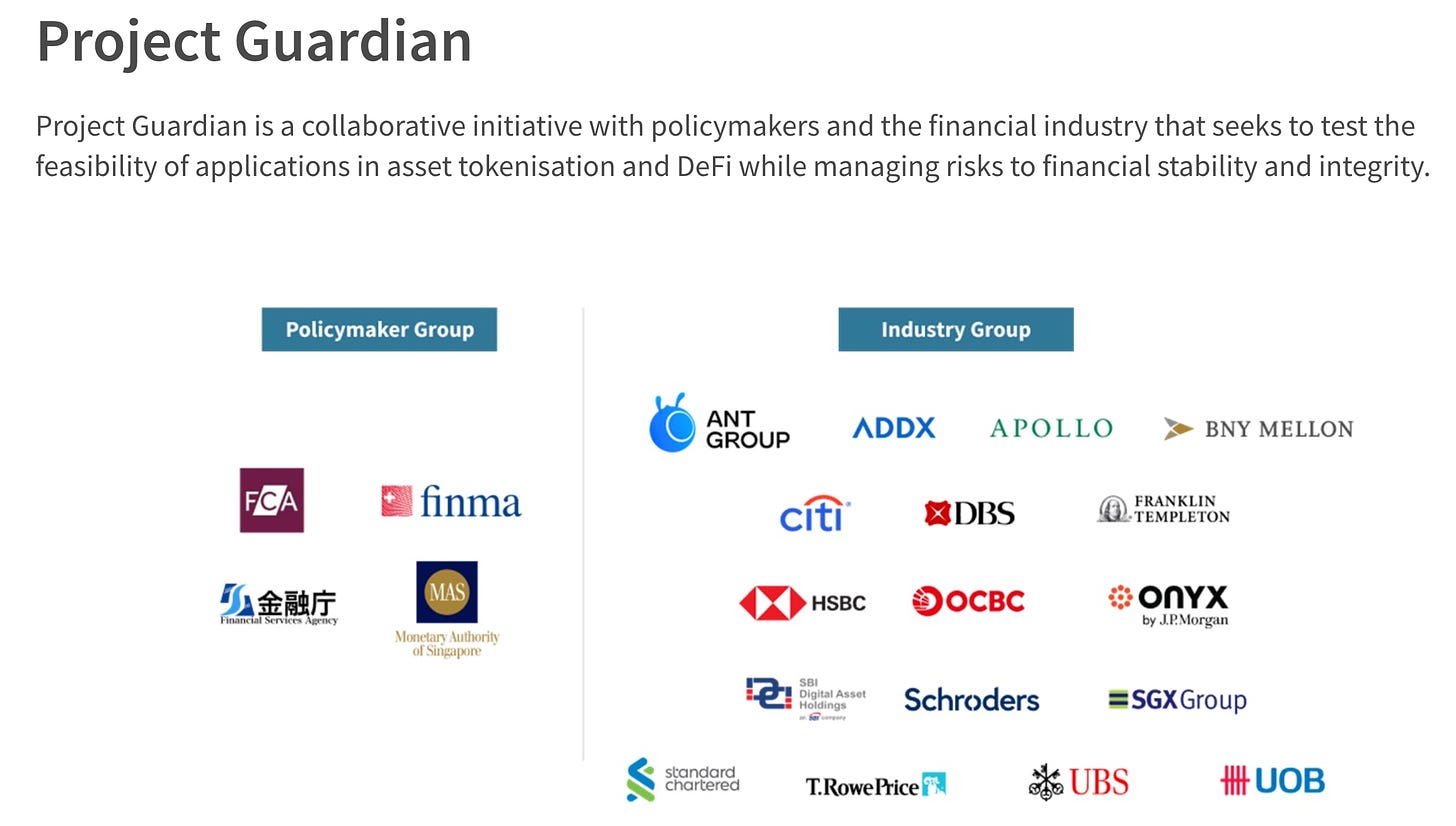

A sign of the future can be found right here in Asia with Singapore. The Monetary Authority of Singapore (or MAS, the city-state’s primary financial regulator) is pioneering adoption with Project Guardian, an initiative exploring the feasibility of asset tokenization and DeFi that goes beyond what other governments have done.

Pilot programs so far have included asset and wealth management products with global financial giants like JP Morgan andFranklin Templeton, bilateral digital asset trades between Citi, T. Rowe Price and Fidelity, and a cross-border FX between BNY Mellon and OCBC. MAS is looking deeper still, with plans to potentially introduce its own blockchain infrastructure that could facilitate cross-border transactions, enable asset trading and more.

Project Guardian’s largest and most intriguing RWA test to date is digitally native Variable Capital Company (VCC) fund shares—a vehicle that would tokenize funds to enable retail investors to provide liquidity, buy tokens or trade the secondary market.

Initial security token fund offerings—including Securitize and SparkLabs, both from 2018—didn’t take off. They may have been too early. It is likely that institutional investment products are what takes the lead with consumer-centric opportunities following later.

Watch this space

RWA is a massive opportunity that many governments—including, also, Hong Kong—are leaning into because, unlike other Web3 developments, it leans on existing financial products and uses blockchain as a ledger to do more. This year, we expect it to move into the mainstream so keep an eye out for developments.

News bytes

Germany’s third-largest bank, DZ, will launch a cryptocurrency trading pilot this year to trial Bitcoin transactions with retail customers

Google and YouTube have begun allowing advertising for Bitcoin ETFs, ending a 5-year ban on crypto-related products—Facebook and Instagram are tipped to be next

Binance is having trouble convincing the UK regulator to allow it back into the country despite its new CEO focusing on compliance

Tether, the issuer of Web3’s most-used stablecoin, made a rare investment after it backed crypto-focused payment app Oobit as part of a $25M round

Han Chang-Joon, the former CFO of Terraform Labs—the firm behind collapsed crypto company Luna—has been extradited to South Korea by Montenegrin authorities. Do Kwon, Terraform Labs CEO, is waiting appeal for a extradition to Korea or the US

Polygon Labs, the company behind MATIC which has worked with Disney and Starbucks, laid off 19% of staff to cut costs. It will also spin out its investment arm and ID product

That’s all for this week!

You can share your feedback, questions or requests via email to: sowhat@terminal3.io