Memecoin season is here—and there’s a lot more to memecoins in 2024

GM,

Dogecoin. Pepe Coin. Dogwifhat. Degen. Shib Inu. Bonk. Based Fink. Jeo Boden. These are some of the thousands of ‘memecoins’ that traders have bought this year. Memecoins are a unique part of the cryptocurrency landscape. Based around tapping online memes, they offer little in the way of utility, trade with limited liquidity and often have volatile price jumps, but they are one of the stories of 2024.

In many ways, memecoins represent the worst of Web3 as they are essentially gambles devoid of skill which can leave buyers with losses of over 90%. But the last month has seen a more positive argument emerge—which makes it high time for a SO WHAT analysis.

Best,

What’s going on?

Dogecoin is the original memecoin. It launched in December 2013 as a joke alternative to Bitcoin, which was gathering momentum at the time, using a popular meme. If Dogecoin had utility, it was to be a digital currency for the internet. It was cheap to send—i.e. low gas fees—and since it had little value, it was used to tip users on Reddit, where it first broke out. Broadly though, it was just for fun.

Fast forward to today and Dogecoin is the ninth largest cryptocurrency based on the total value of all coins (fully diluted valuation, or FDV.) The price has rocketed to where a $3 Dogecoin tip from 2014 would be worth around $100,000 today.

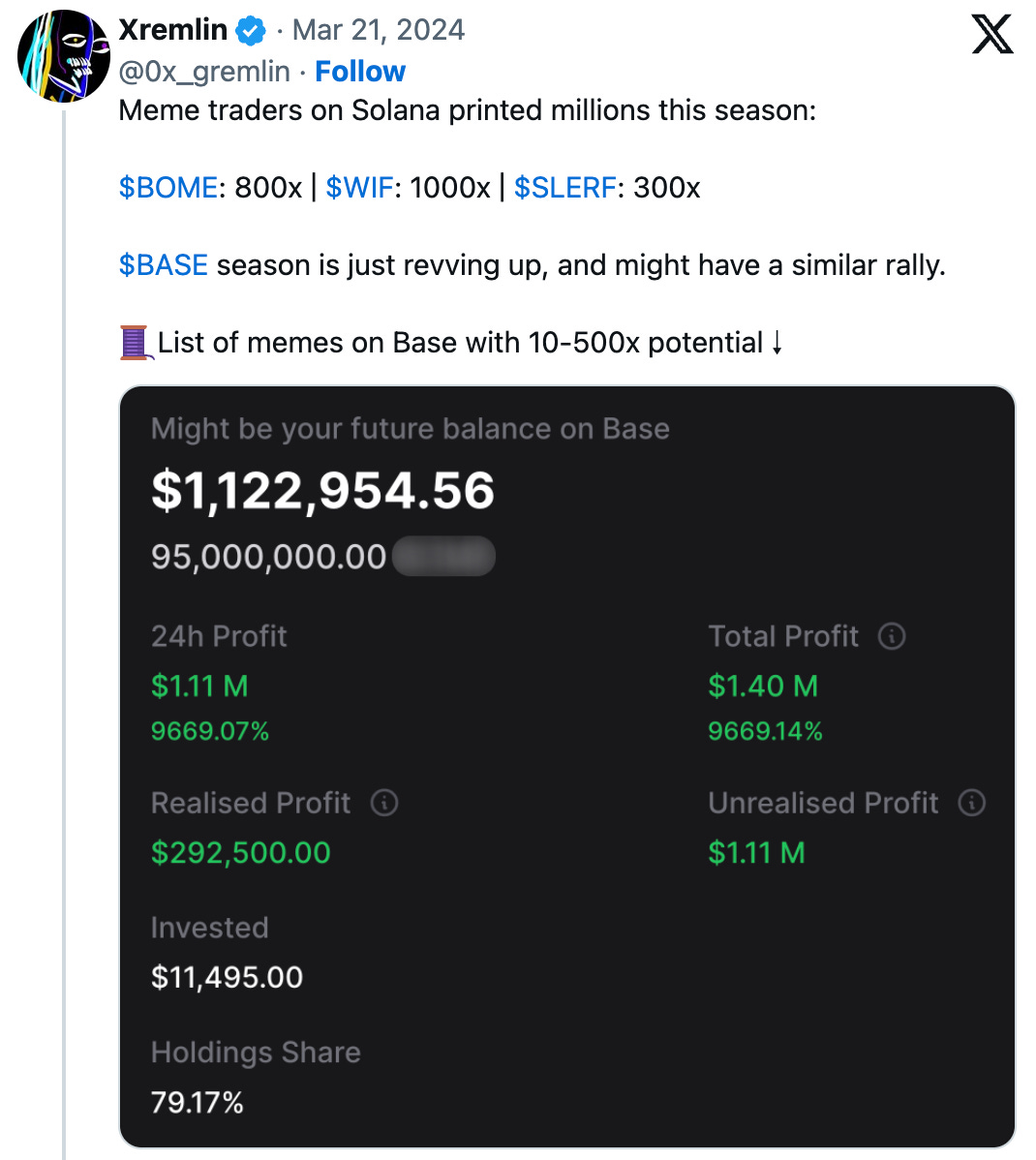

Dogecoin popularized the idea of fun tokens that can deliver a financial windfall for early backers. Tens of thousands of memecoins have launched just this year. A number of them realized similar, astonishing price jumps that Dogecoin has shown but over days instead of years. The memecoin Book Of Meme (BOME), for example, reached a $1 billion FDV within just two days of its launch in March—that timeframe may be a record and netted 20X gains for its first buyers. For every success though, hundreds of memecoins see prices collapse and buyers lose their investment. Plenty are also scams.

This week we look at memecoins using three very different perspectives—which do you agree with?

SO WHAT?

1. The negative: Memecoins undermine Web3

The founding concept of Web3 is to build a better internet based on a few core tenants:

Decentralization: The decentralization of blockchain networks allows apps and services to operate without centralized services, such as App Stores and cloud services, to enable a censorship-proof internet.

Ownership: Wallets enable users to own their own digital assets without the need for middleman or third-party custody services, with control over their own data and the opportunity to monetize it.

User-centric business models: Advertising is the dominant monetization model for Web2 companies such as Google or Facebook. Web3 and tokenization opens the door for business models that reward users and enable services that don’t turn their users into the product.

These principles underline a tectonic shift in how the internet could operate, but memecoins undermine this focus:

- Memecoins have little to no discernible utility

- That means investment in memecoins is speculative

- Memecoins are often ‘pump and dump’ schemes that benefit insiders who buy early

- Prices are volatile and investors who buy memecoins most often lose their money

- These factors could lead regulators to take action against memecoins

There’s a distinct danger that the negative aspects of memecoins could cause irreparable damage to Web3 that ultimately undermines the potential for it to fulfill its promise of a bright new era for the internet.

2. The positive: Memecoins are Web3’s biggest success

Memecoins are a new breed of cryptocurrencies that can bring tens of millions of new users into Web3.

Security, self-custody and decentralization are noble causes but they’re often not tangible to mass market users who prefer services and apps that just work and are simple to use. Web3 has the tools to change the internet but, for now, the technology remains difficult to use. Memecoins are a positive addition to Web3 because they act as a gateway that brings new users into the ecosystem, normalizing Web3 concepts like self-custody of assets, crypto wallets, gas fees and more.

The volatility of tokens will also encourage retail investors to invest carefully using research and analysis, though they may learn from initially doing the opposite with memecoins.

Memecoins are becoming an increasingly important strategy to Web3 platforms, too.

Solana and Base, the Coinbase-owned blockchain, have benefitted from a glut of memecoins launching on their network. Solana reached a record 2.1 million daily users during March, while the same month saw Base reach record daily transactions and doubled its TVL, total value locked.

TON, the blockchain that is integrated with popular messaging app Telegram, has a vacancy for a memecoin ecosystem lead who would help grow the TON ecosystem by helping “build and enhance [its] memecoin ecosystem.”

Expect every blockchain network to follow the same strategy if they aren’t already.

3. The future: Memecoins are only just getting started—we don’t know what comes next

The most fascinating part of Web3 is the speed at which it moves and innovates. Memecoins have been a hot topic over the last few months and already there’s plenty of speculation over where it is headed.

Andrew Kang, a co-founder of Web3 investment firm Mechanism Capital, called the newest batch of popular memecoins “coins of culture.”

“Communities with strong values and identities naturally try to convert others to their beliefs and publicly display what it is they love about their lifestyle. They are inherently viral. The ideologies of these communities can be purely about politics, religion, consumer goods, sport, way of life or can be a mixture of all,” he wrote.

Kang cited memecoins launched around US presidential candidates Trump and Biden as proof that those which do well are “simply assets that people can best believe in.”

Other investors have also speculated that memecoins of 2024 and beyond can be much more meaningful. Li Jin of Variant fund called Memecoins part of a new “attention economy” and speculated that brands, influencers and others could parlay their presence and popularity into a token.

NFTs haven’t worked so well for brands—as we explained with the closure of Starbucks’ Odyssey collection—and it is unlikely we will see brands diving into memecoins with its lack of regulatory clarity in the US right now. But there’s certainly plenty to assess, with Jin herself breaking memecoins themselves out into distinct categories.

Memecoin season is certainly in session. As with many things in Web3, it is fun to dabble and see the principles of self-custody, decentralized exchanges and price volatility first hand—but anyone buying is advised to invest amounts they can afford to lose.

Taking part in crypto helps us to understand where things are moving to—certainly memecoins have a lot more credibility now in 2024. Who is to say how they develop and innovate from here on.

News bytes

A new stablecoin bill is headed to the US Senate—its goal is to give regulators the power to weed out bad actors whilst also allowing stablecoin issues to emerge in the US

Top stablecoin Tether is estimated to have made $6.2 billion in net income last year, highlighting just how important and lucrative stablecoins are (despite Tether’s controversies)

Ripple’s newest competitor will be a stablecoin from Ripple, the firm behind the XRP token and cross-border banking software

Monad Labs, a new blockchain that aims to be faster than Ethereum at processing transactions, raised $225 million from a list of top investors ahead of plans to launch its network and native token

Paraguay has moved to temporarily ban Bitcoin mining over concerns that miners steal power and disrupt the country’s electricity supply

Bitkub, Thailand’s top crypto exchange, is reportedly planning an IPO in 2025—it previously saw a billion-dollar acquisition from Thailand’s oldest bank fall apart in 2022

That’s all for this week!

Share your feedback, questions or requests via email to: sowhat@terminal3.io