Meet Pump.fun, the memecoin factory making $1M a day

GM,

One of the most lucrative companies in Web3 today may also be one of the most controversial. This is not a company aiming to build a new internet, democratize financial services, or pursue other lofty goals. In fact, critics accuse it of enabling gambling, although some have praised it for helping cryptocurrencies reach the masses.

This week, we dive into the crazy world of Pump.fun, a platform that has created more than 2.5 million crypto tokens and is making nearly $1 million a day.

Best,

What’s going on?

When we wrote about memecoins earlier this year in April, we speculated that there was much more to come this year—but little did we know it would arrive in the shape of a baby hippo from Thailand.

Her tiny size and playful nature made Moo Deng into a viral sensation in September after the Khao Kheow Open Zoo where she lives posted her photos, videos and live streams online. The hippo’s profile grew to international levels during September, becoming a topic on a range of US TV shows including Saturday Night Live.

What happened next, though, was unexpected.

A Moo Deng memecoin was created on Pump.fun in mid-September and it rose sharply to over $0.30 at the end of September—a massive jump from $0.024 barely a week earlier.

That heady period of trading helped early buyers make incredible gains, with one turning an initial $800,000 into a $7.5 million return.

Moo Deng fever has spawned t-shirts, sent visitors to the zoo and more—but in the land of Web3, it has catapulted Pump.fun from a successful operation into one of the top earners in the industry.

Those aspiring to launch the next Moo Deng coin are flocking to Pump.fun while buyers, keen to make a fortune, are jumping in and buying up tokens that they believe could become established memecoins. In the middle sits Pump.fun, which has seen revenue sky rocket to nearly $1 million a day—but how does it work, and can this memecoin mania continue?

SO WHAT?

1. Inside the memecoin factory

Pump.fun works by enabling anyone to launch a token on its Solana-based platform. The token is then listed on its website, where anyone can buy it using a variety of Solana wallets.

The price of tokens increases as more buyers purchase the token. Once the market capitalization of a token reaches $69,000, a portion of the liquidity is deposited in Raydium—a Solana-based decentralized exchange (DEX)—and then burned. The token is then migrated from the Pump.fun platform and available to trade across Raydium and other DEXes that support Solana.

Once a token migrates, it can potentially take off as Moo Deng did.

The model is quite straightforward—tokens that gain popularity graduate the platform—but the reality is that most do not follow this route.

Fewer than 2% of tokens created successfully reach that $69,000 market cap and migrate from Pump.fun, according to data from Dune Analytics. That’s why the platform is often branded gambling.

Even among the tokens that have ‘made it,’ few have had any significant impact on the wider crypto industry. Many coins are over within a day or two of launch, as buyers sell out for returns or losses and move on to the next one in the hope its price will ‘pump’ so they can sell for gains.

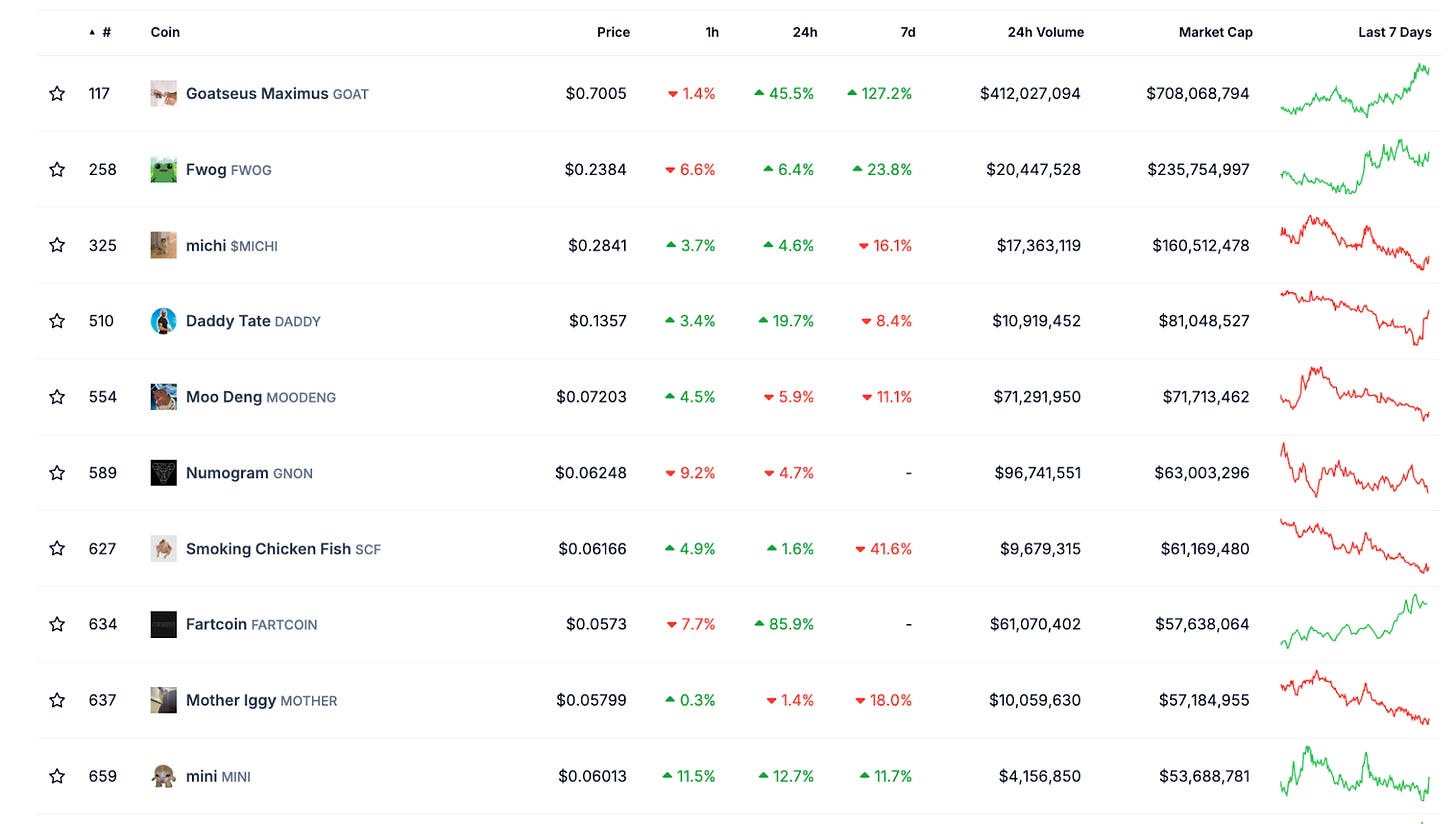

Among the top ten coins that graduated Pump.fun, none have cracked the top 100 cryptocurrencies based on valuation—and none are even among the top 10 memecoins which include Dogecoin, Shiba Inu, Pepe and others.

It’s already debatable whether popular memecoins bring value to Web3, but for Pump.fun coins, that argument is even harder to make.

2. Memecoin money maker

Ethically, the value of Pump.fun to the industry may be in doubt but what’s for certain is that it is one of the most lucrative companies in the industry.

“During a gold rush, sell shovels.” The popular phrase applies perfectly to memecoins. In the frenzy for coins, Pump.fun sits happily in the middle as an enabler of both token creation and trading.

How does it make its money?

Pump.fun charges 0.2 SOL (around $35 at current prices) for every coin issued. Initially, this was picked up by the coin issuer but it shifted and now the cost is borne by the first buyers of a token.

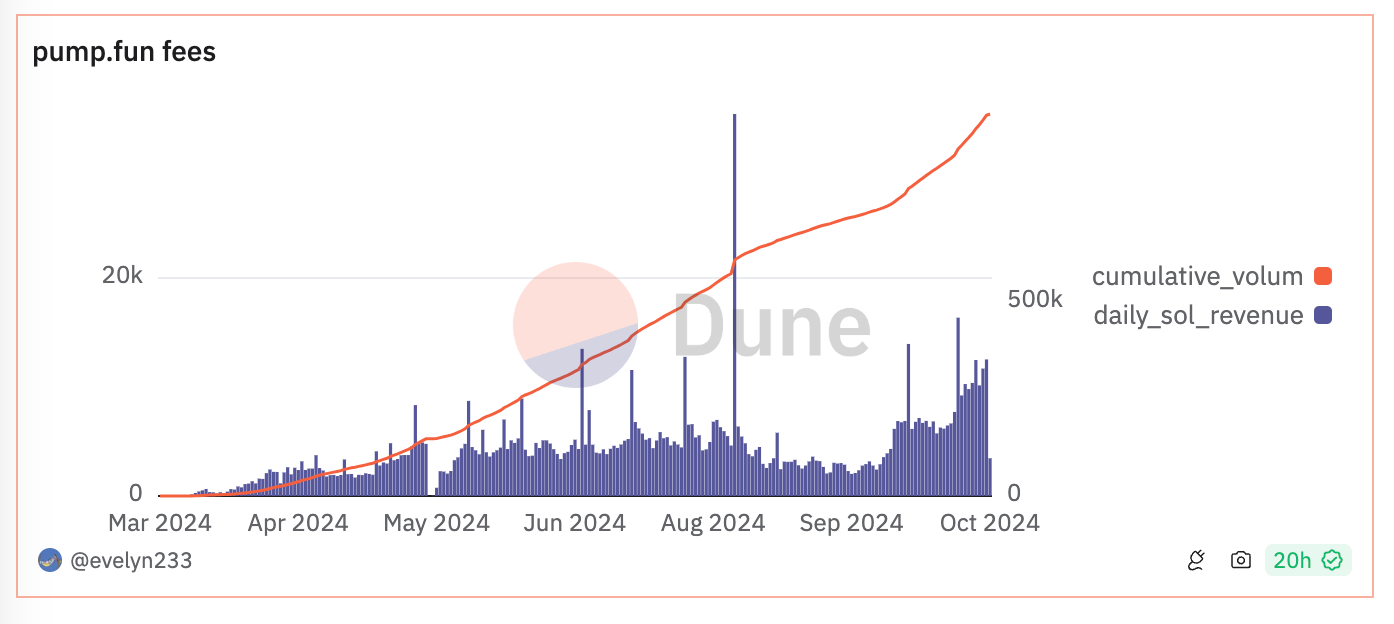

The platform also takes a 1% fee on all transactions. That’s relatively low compared to other platforms, but the sheer volume of tokens and trading means it is substantial. As memecoin mania hit in late September following the rise of Moo Deng, Pump.fun income from fees increased significantly, as the chart below from Dune illustrates.

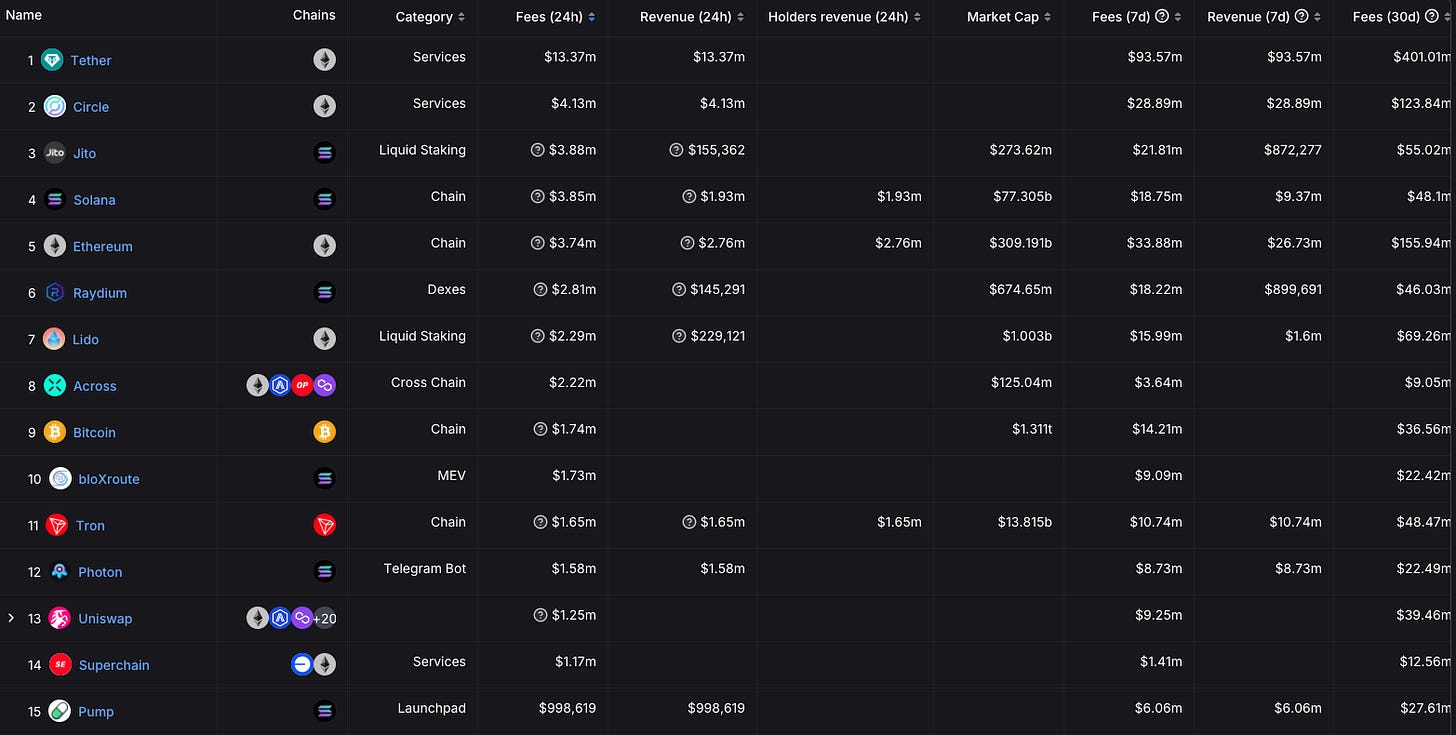

These numbers make Pump.fun one of the biggest earners in all of Web3, not far below protocols like Ethereum, Uniswap and Solana as well as trading services like Photon.

But there’s more to come.

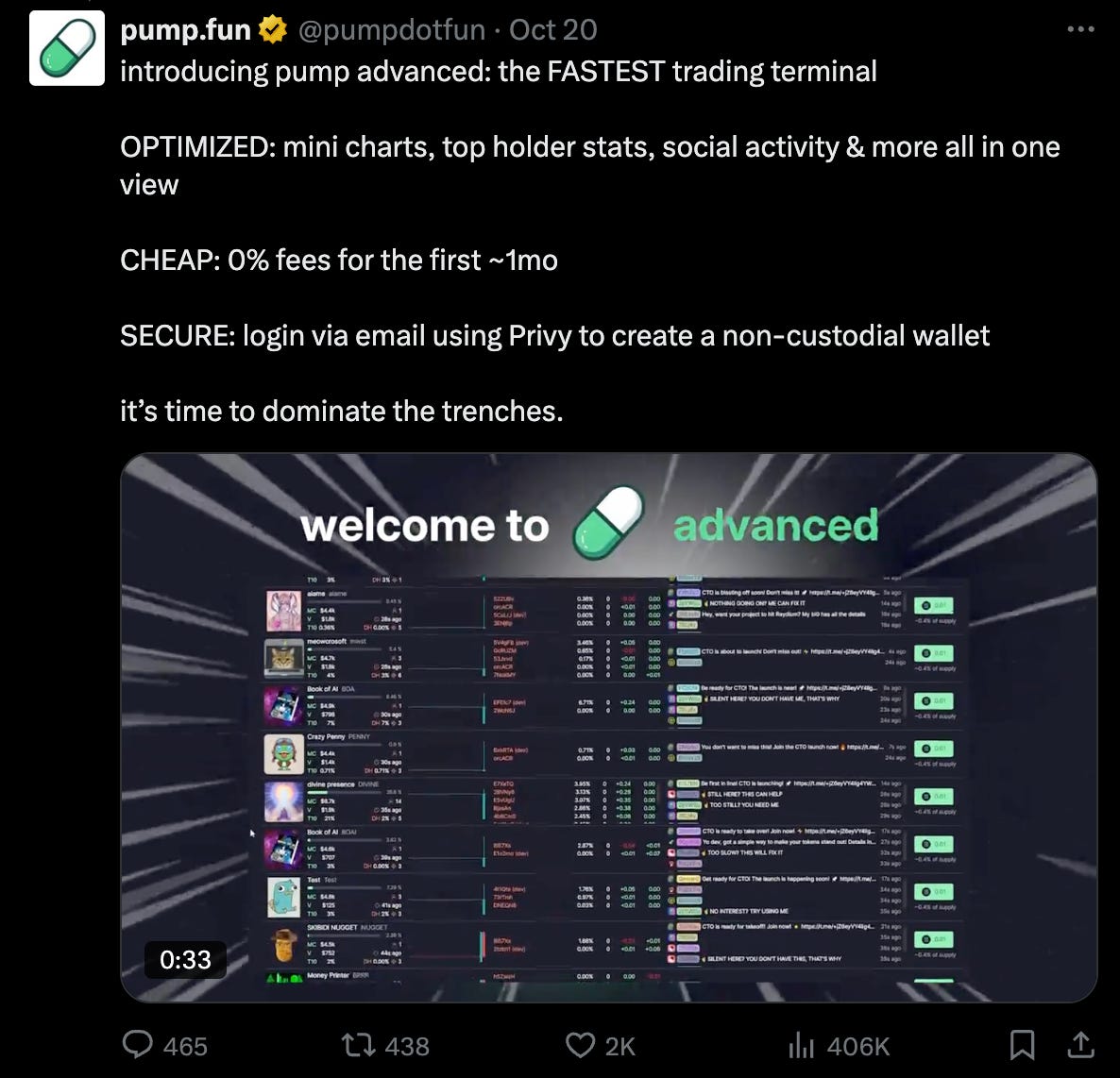

Sensing a chance to do more, Pump.fun recently announced a new paid service offering advanced trading features and analytics. Pump.fun will also remove all fees for the first month.

There’s no price for Pump.fun Advanced service yet, but aside from drawing additional revenue from its super users, the idea will be to keep traders on the platform longer and help improve the odds for buyers.

Currently, many of the most active traders turn to platforms like the aforementioned Photon for a more holistic buying and analytics experience since Pump.fun’s features are limited to buying and selling. Other platforms allow buyers to create pre-set buying and selling based on prices and price changes, see more visual representations of their trades and more.

3. Painting a target on its back

Pump.fun’s final plan is to introduce its own token, according to an announcement on 19 October.

There’s no specific details right now and it won’t be straightforward as to how the token will work. It could represent an opportunity to increase engagement with its most active traders and draw significant revenue—we’ve already written how Coinbase’s Base and Telegram’s TON token projects have boosted their respective revenue streams and opened a new dimension to their businesses.

Companies that issue tokens, however, run the risk that a poor performing token can negatively impact a company’s reputation, and that can be very difficult to turn around.

Issuing a token is going to place an even larger target on Pump.fun for regulators.

Already, there’s been chatter that they’re keeping a keen eye on the platform. That’s to be expected given how the SEC is laser focused on prediction markets like Polymarket, which made moves to prevent US-based users.

Pump.fun is even more clearly at odds with US investment rules, simulating the investment process and typifying the negative ‘pump and dump’ philosophy within Web3.

One area of initial attack for the SEC may be celebrities, who have taken to the platform in numbers, as CoinTelegraph wrote:

The tool has become a trend among celebrities to create and promote memecoins with United States-based figures, including Caitlyn Jenner, Iggy Azalea (real name Amethyst Kelly), Jason Derulo (real name Jason Desrouleaux) and many others, who have launched and promoted crypto tokens using their likeness since May.

Right or wrong, the platform is the hottest thing in Web3 right now and its impact is being felt elsewhere.

Tron founder Justin Sun created SunPump, a Pump.fun copycat on his TRON blockchain, in August while Dexscreener, a popular service for token analytics and trading often in tandem with Pump.fun, introduced its own launch platform in June: Moonshots. Another popular launch service exists on Binance’s BNB chain; other blockchains have or will soon have their own versions, too.

These launches show that the movement for memecoin creation has already moved beyond Pump.fun, and that’s likely to mean more tokens, many more celebrities and the inevitable regulatory scrutiny. Oh, and plenty of stories of retail traders making millions of dollars from a single trade!

News bytes

Crypto casino Metawin lost around $4 million in tokens after hackers exploited its withdrawal system to access wallets

Swiss bank UBS, which manages over $5.7 trillion in assets, launched its first tokenized fund on Ethereum

Stablecoin issuer Tether is one of the most fascinating companies in Web3—often criticized for the opaqueness of its reserves, it is one of the most profitable: its most recent financial announcement claimed a $7.7 billion profit in the first nine months of 2024

Blockchain gaming company Immutable is the latest Web3 name to receive an SEC Wells Notice, which it says “non-specifically alleges violations of securities law and alleged misrepresentations by the company”—Coinbase, Consensys, Ripple and OpenSea are among others to receive a notice of late

Layoff season isn’t done in Web3, it seems, after Kraken let go of 15% of its 2,600 employees including (surprisingly) its COO and CTO—the company has been linked with going public for some time now

That’s all for this week!

Share your feedback, questions or requests via email to: sowhat@terminal3.io