How Bitcoin looks at $100K compared to $1K

GM,

The world of Web3 is crazy at the best of times, but it’s been a particularly wild ride over the last few weeks since Donald Trump won the US Presidential election. The President-elect has said a number of positive things about crypto and Bitcoin generally—his win saw the market prices jump with Bitcoin now on the gates of $100,000 per coin.

Bitcoin’s price fell back in recent days, but its overall rise led us to assess what major things have changed since Bitcoin was at $1,000-$2,000 less than 10 years ago.

Best,

What’s going on?

Twelve years ago—at the end of November 2013—Bitcoin surged to a then-record-high of $1,000. It would be another three and a half years before it reached $2,000.

It feels quite surreal to remember that now with the cryptocurrency on the verge of hitting $100,000. As a journalist, I’d written about Bitcoin for many years before I finally made my first (sadly non-substantial) BTC purchase via Coinbase in 2016 so it is fair to say I’ve followed it closely.

For this week’s issue, I wanted to look back at what has changed from those early days and what that might mean for the future of Web3.

SO WHAT?

1. Bitcoin is more accessible than ever

Bitcoin wasn’t easy to buy in the previous decade. Not like it is today.

Exchanges like Coinbase, Binance, Crypto.com and others allow users to buy Bitcoin in large quantities typically after verifying their identity. Then, since last year, there are ETFs that enable a different type of owner—one who doesn’t want to get into the weeds of buying (or storing) their BTC and one who may take investment advice from a financial advisor.

In 2016, when I bought my first fractions of Bitcoin, I went through Coinbase which had a strict purchase limit of $50 per day. But that felt like a safer bet than other exchanges, given how Mt Gox—once the world’s largest exchange holding 70% of all BTC—went belly up in 2014 after a theft saw 25,000 BTC from customers lost. That was $400,000-worth at the time,; today it’sthat’s more like $2.5 billion.

There’s a funny story of how Pantera, one of the first institutional purchasers of Bitcoin, had to ditch Coinbase to buy Bitcoin back in 2013—a move that made its partners billions of dollars.

Acquiring Bitcoin wasn’t just difficult, keeping hold of it was, too.

There was little trust in exchanges due to the Mt Gox theft, but Bitcoin technology was also slow and ungainly, too.

Self-custodial wallets, which allow users to keep hold of their crypto assets without relying on a third-party, were rudimentary and Bitcoin had a scaling issue. Transactions were expensive and slow, often leaving the sender to wonder when the asset transfer would be completed.

Miners were divided on what technology pathway to take in order to ease network congestion, as I wrote as recently as 2017.

Things look much different today.

Bitcoin has introduced a number of technology advancements that have eased network congestion, and even introduced new features including NFTs and memecoins.

Transactions now are far quicker and considerably cheaper. There’s still work to be done to improve both of these but the user experience is significantly improved, and there’s no longer that lingering worry that you accidentally sent assets to a wrong address or made another critical error.

The technology side may not be sexy, but it is an essential evolution that paved the way for Bitcoin to become more widely adopted.

2. Bitcoin is legitimate now

It seemed unlikely in the early days of Bitcoin, which was used to buy illicit goods on black markets like The Silk Road, that it could ever become an asset for institutional investors and even governments. But here we are.

The Bitcoin ETFs opened the door for anyone in the US to easily own BTC, not to mention banks and funds, too. That has’s spawned similar ETF products in other countries, and even an ETF for Ethereum in the US. Many other crypto-based ETFs are likely to follow in future years., you’d imagine.

Then there is government adoption.

Incoming President Trump wants to put Bitcoin into the US federal reserve. While there is plenty of debate as to whether that will actually happen—and if so, whether it will be a meaningful amount—other governments are already using Bitcoin as part of their economy.

- El Salvador introduced Bitcoin as legal tender in June 2021—today its BTC assets are worth over $500 million

- Bhutan has been quietly mining Bitcoin for years—today it is the fifth largest Bitcoin holder with assets worth over $1 billion

The corporate world is adopting Bitcoin in some areas, too:

- Both Tesla and Block (the payment firm formerly known as Square) park some of the funds in Bitcoin

- Meitu, a company that makes selfie apps and hardware, is Asia’s largest Bitcoin holder after it started buying crypto assets in 2021

- MicroStrategy has a very aggressive Bitcoin acquisition strategy: it is buying another $10 billion in Bitcoin funded by a $42 billion equity and debt fundraise—it now holds 2% of all BTC and is pledging to buy at above $100,000

The arrival of such imposing corporate Bitcoin custodians suggest that Bitcoin has found its market fit as an investment asset that’s akin to ‘Digital Gold’ rather than cross-border or payments, as it had been heading to a decade or more ago.

3. But has Bitcoin sold out?

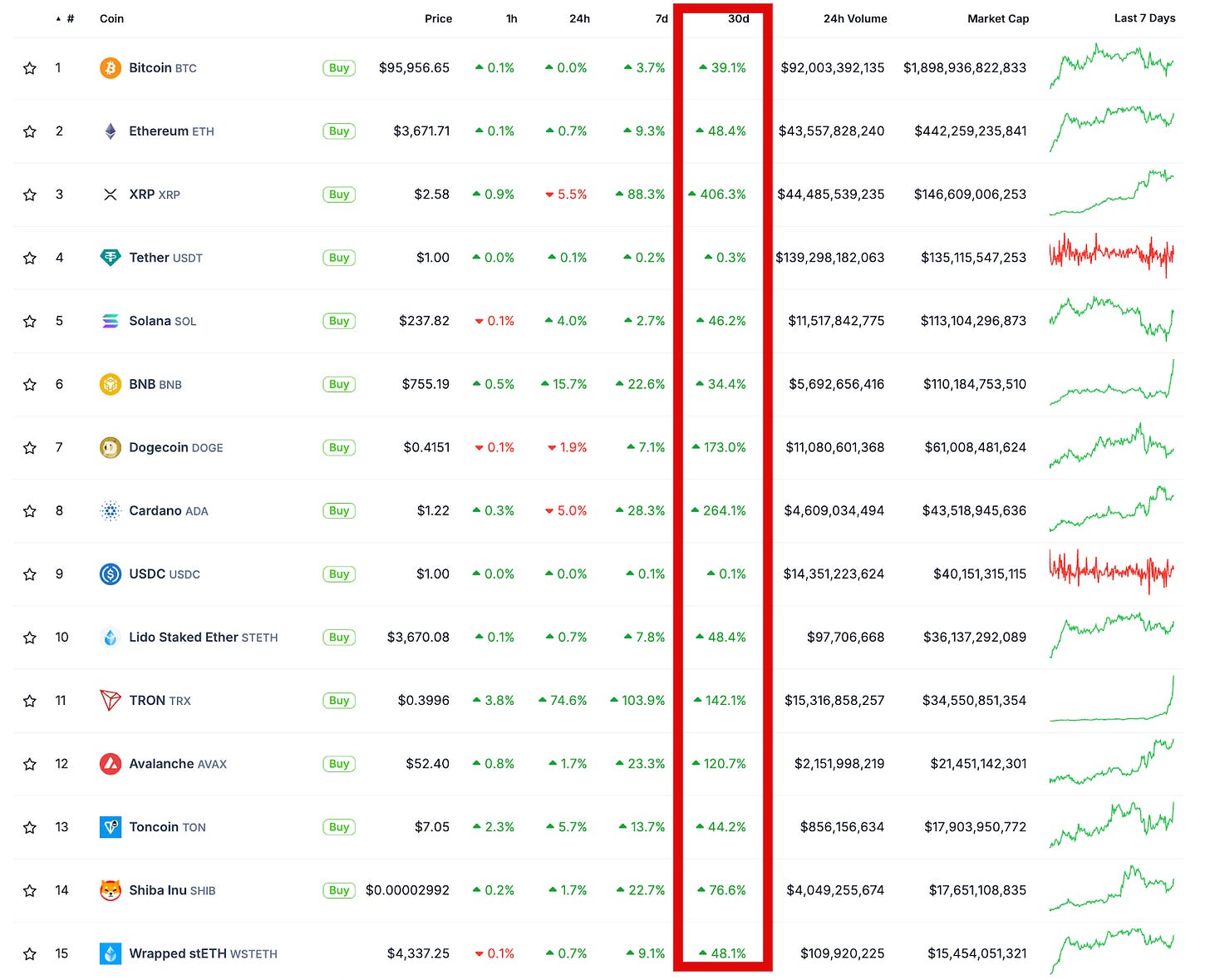

The US Presidential election has sent the value of Bitcoin, Ethereum and other cryptocurrencies soaring. Bitcoin is up 39% over the past month at the timing of writing, Ethereum is up 48% and the list goes on…

Yet for all the green candles in the market, there is a strong sense that Bitcoin has adjusted its moral compass.

Satoshi Nakamoto created Bitcoin as a hedge from the dominant existing financial and political institutions that run the global economy, and caused the 2008 economic depression which Nakamoto’s creation was a response to. The idea was a borderless currency that couldn’t be manipulated or influenced by those in power.

Now, though, there’s excitement when MicroStrategy doubles down or Donald Trump, a man known for hyperbolic and jingoistic statements, airs vague plans to buy BTC for the US government.

Bitcoin’s continued progress and future price inflation is reliant on adoption from those very institutions that it was built to safeguard against—and that doesn’t feel like progress. That feels like Bitcoin has been co-opted.

It could be, though, that this is Bitcoin’s premise all along. To be the front door to Web3. To be the asset that brings liquidity into Web3 and eases the pathway for more disruptive services and strategies that are more tightly aligned with Nakamoto’s whitepaper.

At the recent Devcon conference in Bangkok laid on by the Ethereum Foundation, there were dozens of talks and events that focused on areas where decentralized internet or networks can improve society. Around elections, or better social networks and more inclusive, payment systems, to name just a few.

That cyber punk-like spirit hasn’t disappeared from Web3, but increasingly it feels like Bitcoin no longer defines the movement. Instead, it has moved on to mean something else altogether. A mainstream manifestation of Web3, which those who believe in the virtues of decentralization, will hope can act as a trojan horse for future Web3 innovation.

News bytes

We wrote about Pump.fun last month and the memecoin launch platform shut down its livestreaming feature after it was abused and poorly moderated

Gary Gensler will step down from his role as the chairman of the US SEC in January—it is not yet clear who will replace Gensler, who had taken an aggressive stance on regulating crypto

Alex Mashinsky, the former CEO of Celsius—the crypto lender that filed from bankruptcy in 2022—has pleaded guilty in a crypto fraud case

Coinbase is listing virtual memecoin Moodeng on its exchange—this is significant since Coinbase represents the most conservative and regulated exchange while Moodeng is the coin that kicked off frenzied memecoin activity and Pump.fun’s success

MicroStrategy CEO Michael Saylor has implored Microsoft to buy Bitcoin, giving a 3-minute presentation to the company’s board

Nike is closing down RTFKT, the NFT store it purchased in 2021 which sold virtual sneakers

That’s all for this week!

Share your feedback, questions or requests via email to: sowhat@terminal3.io