Farcaster, the billion dollar Web3 social project, has ambitious plans

It may not have huge user numbers but its goal to connect social networks and apps fulfills an ambition Twitter once held

Web3 social media service Farcaster raised eyebrows in May when it announced that it had raised a massive $150 million round that valued its business at $1 billion. Many stories at the time focused on the fact that Farcaster had around 50,000 active users—with some sleuths suggested the number was even lower.

The unicorn valuation—the so-called phrase for a company valued at $1 billion—was surprising but Farcaster and its investors came in for heavy criticism. While its business remains embryonic and risky, there’s a lot more to it than just simply a decentralized Twitter clone.

Let’s get into the details.

Best,

What’s going on?

Few Web3 companies have landed unicorn valuations from investors, and probably none have done so with a profile that’s as low as Farcaster’s.

Its $150 million Series A round was led by Paradigm, a Web3-focused fund, with a number of peers including a16z’s crypto fund and Haun Ventures—run by former a16z executive Katie Haun—joining. Dan Romero, Farcaster CEO and co-founder and an early Coinbase employee, said the capital would support the business for “many years to come.”

Farcaster previously raised $30 million in July 2022

So what exactly is being built?

Farcaster is just one part of the business—which is known as Merkle Manufactory. The team is building a protocol that could connect apps and social media, as well as the Farcaster social network which is akin to an onchain-version of Twitter.

It’s that dual approach of developing an app and the infrastructure and rails which power it, which makes Farcaster stand out from other social networks out there—and that is what marked it out for investors.

SO WHAT?

1. More than just applications

In April 2009, Y Combinator founder Paul Graham wrote a short but much-referenced essay to explain that Twitter was exciting because it was a protocol and not just an app.

“The reason [Twitter is exciting] is that it's a new messaging protocol, where you don't specify the recipients. New protocols are rare,” Graham wrote. He went on to suggest that Twitter’s reluctance to monetize and control the product made it fascinating as it could become anything.

Fast forward to 2024 and Twitter is not a protocol. It hasn’t been for some time even before Elon Musk took over. It has become a private company social network that makes money through advertising—just as Facebook, Instagram, TikTok and others do.

One of the early concepts of Twitter was that it could tie into all other social apps to build a status or communication layer. Now, Farcaster is building a protocol for that exact purpose.

Farcaster claims 350,000 paying users as of May 2024

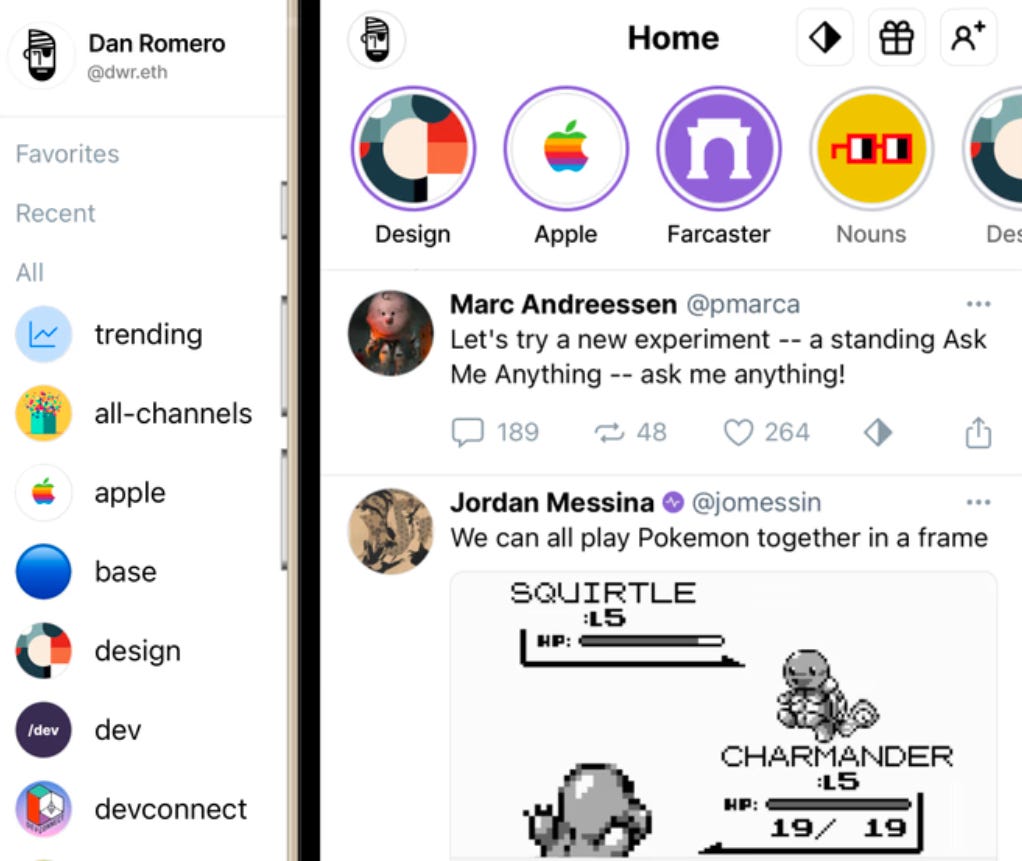

Using Warpcaster, Farcaster’s mobile app, shows a very different experience to Twitter.

Each user has a crypto wallet and must pay an annual fee of $3 to use the service. That means they are immediately presented with payment options when onboarding.

Farcaster includes a number of interesting features that include:

- Dedicated communities

- Unique user IDs with connected wallets, making it less susceptible to fake accounts

- Gate communities which can only be access by holding NFTs or tokens

- Frames, which let developers build mini apps in message—such as e-commerce, NFT minting, games and more

These features become even more powerful if a user social graph can be exported elsewhere. That could mean sharing information from other apps like trades or game achievements, or simply being able to connect with friends or access content across multiple apps.

We have had a taste of this with social logins and other social media features, but meshing them together is the promise that Farcaster is chasing.

2. Farcaster can make money

Giving Farcaster a billion-dollar valuation was always going to grab attention. The deal had been criticized by some as VCs simply putting money to work in order to earn management fees, but that’s a highly cynical approach.

The reality is that in order to raise a sum as substantial as $150 million, a valuation is going to be in the range of $500 million to $1.5 billion. So a more pertinent question may be why Farcaster required this much money.

Warpcast, the app, is just one component. Developing a protocol takes serious engineering talent and power. And, as Romero hinted, the company is planning for years of development which is likely to include many more apps, developer connections and much more.

One component of the deal may well be future token options. Investors frequently get access to tokens either by buying them as part of their investment as opposed to equity, or through token warrants which grant tokens alongside equity or enable equity to be swapped for tokens.

It may not have advertising for now, but, as a protocol, Farcaster could unlock lucrative opportunities in the future if it issues a token and is able to scale its business. When we looked at Base earlier this month, we explained how gas fees generated from transactions earned Coinbase significant revenue—as much as $17 million in March.

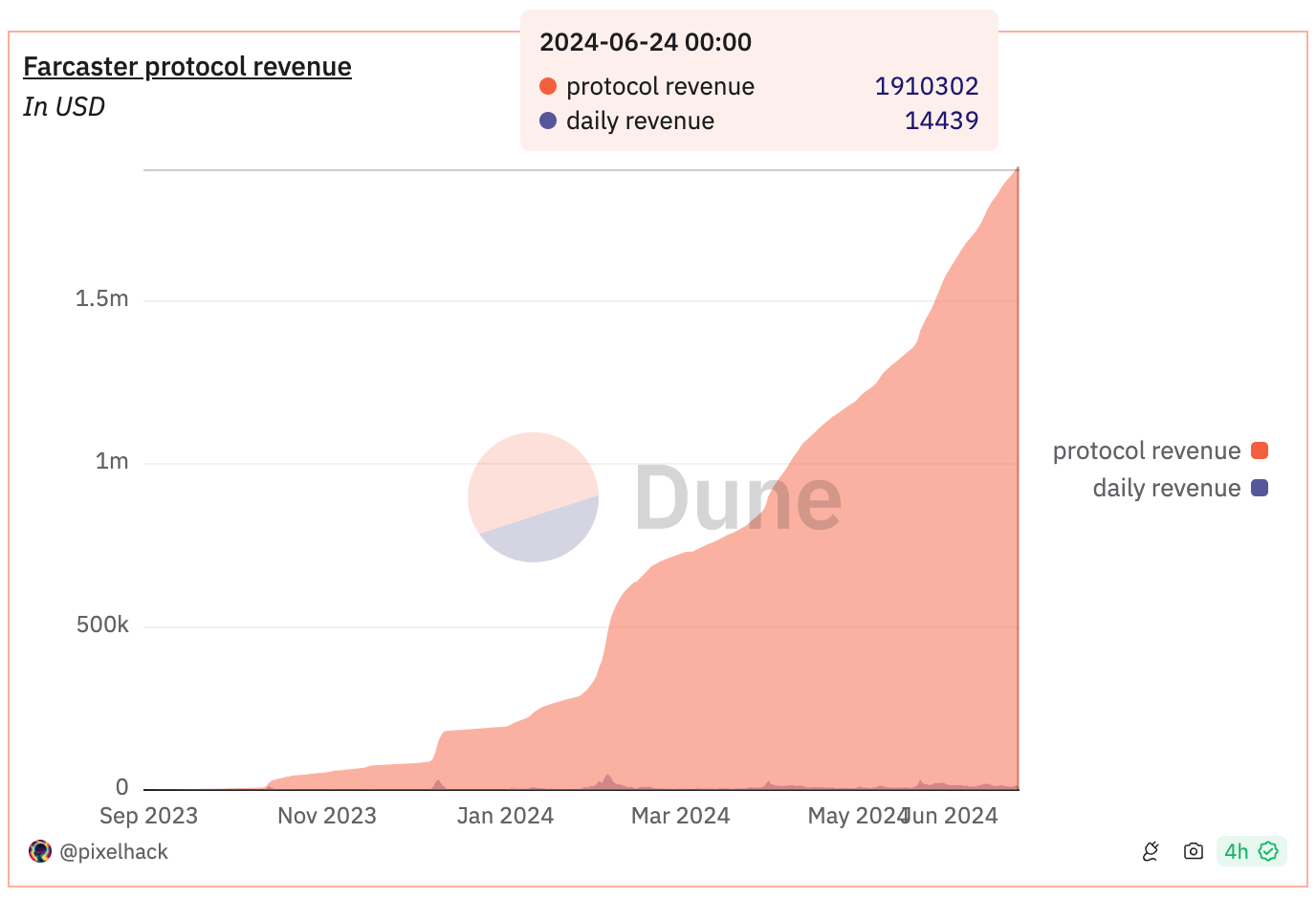

If Farcaster can integrate a range of social apps, increase the number of developers deploying apps on its protocol and, of course, grow its user base, then it too could generate serious income. Since October, Farcaster has made $1.9 million from protocol fees, according to on-chain data present in Dune.

Now, imagine what happens to those revenue figures if the company grows the user base from 50,000 to 5 million or even 50 million.

That’s significant operating revenue but also the kind of activity that could support a strong token. Either of those scenarios, let alone both, mean strong returns for investors—potentially even at this lofty $1 billion valuation.

3. How does this play out?

There are two schools of thought for the future of Farcaster: the bullish and bearish case

THE BULL CASE

Farcaster is not alone in building a decentralized protocol. BlueSky has 5.8 million registered users. Mastodon claims 10 million registered users. Even Facebook’s Threads app has pledged to integrate decentralized protocols.

Unlike its peers though, Farcaster is the most Web3-centric platform. It is building beyond integrated other social media to include apps, services, payments and a lot more. Farcaster would catch a tail wind if its services are broadly adopted, and it becomes the social layer for Web3 apps beyond simply a place for sharing status updates.

Broader adoption would need Web3 apps to progress beyond their niche community. That would mean a Web3 app would need to break out beyond trading or NFTs.

THE BEAR CASE

Twitter has had rivals before. App.net was a developer-focused platform that required all users to pay. It ultimately failed to achieve scale. That’s the most obvious challenge for Farcaster, and it is yet to be seen whether other competing decentralized apps help or hinder.

None has significant market share, but they serve to confuse the public by offering services that are not easily indistinguishable. If Farcaster is unable to stand out then it stands the risk of failing to reach a significant number of users and remaining irrelevant.

If the crypto market descends into a bearish cycle, Farcaster’s core Web3 base of users may become less active and engagement may fall.

Either way, Farcaster is developing an ambitious and unique project that is certainly worth watching even without the significance of a $1 billion valuation.

News bytes

The US SEC is said to have dropped its investigation into whether Ethereum is a security, boosting the cryptocurrency and others

Pantera, one of the early Web3 funds, is raising a new $1 billion fund

Pantera is also raising a new fund to invest in TON, the token aligned with messaging app Telegram, which we profiled earlier this month

The President of Jump, another pioneering Web3 fund, is stepping down in the wake of reports that the CFTC (Commodity Futures Trading Commission) is investigating his firm

Standard Chartered is setting up a trading desk for Bitcoin and Ethereum

Brazil is planning to tax overseas-crypto exchanges that do business in the country

That’s all for this week!

Share your feedback, questions or requests via email to: sowhat@terminal3.io