ETFs will change the game for Bitcoin—we just don’t know how yet

GM,

Last week, we started a series exploring three ways in which digital assets will mature in 2023, and today’s installment dives into way #1: US Bitcoin ETFs.

This isn’t to pump bags or polish cryptocurrency tokens but to explain that, after years on the fringe, crypto and Web3 technology is becoming relevant to legit businesses across the world.

This week, we are exploring the details of Bitcoin ETFs in the US after nine Bitcoin ETFs launched for trading in the US on 11 January. You’ve probably felt the hype—it’s been hard to miss—but this is a truly seminal moment, and we will explain just why.

Best,

SO WHAT is an ETF?

Exchange Traded Funds (ETFs) are a type of investment fund that trade on stock markets and track financial products and commodities, such as bonds, debts, gold bars and now even Bitcoin.

By being exchange-traded, i.e. on stock markets, they allow investors that invest only in publicly traded products to gain access to different types of assets without owning them. That’s a crucial part of the appeal of Bitcoin ETFs.

SO WHAT is the history of ETFs?

ETFs originated in Canada with the first US ETF launching in 1993. They took off in the 1990s by offering “more exotic trading strategies” to the masses, to quote the Wall Street Journal.

The US ETF market is estimated to be worth nearly $7 billion, representing 12.7% of equity assets. The new US Bitcoin ETFs broke records with $4.6 billion in volume on the first day of trading. Trading hit $11.95 billion within the first four days of trading.

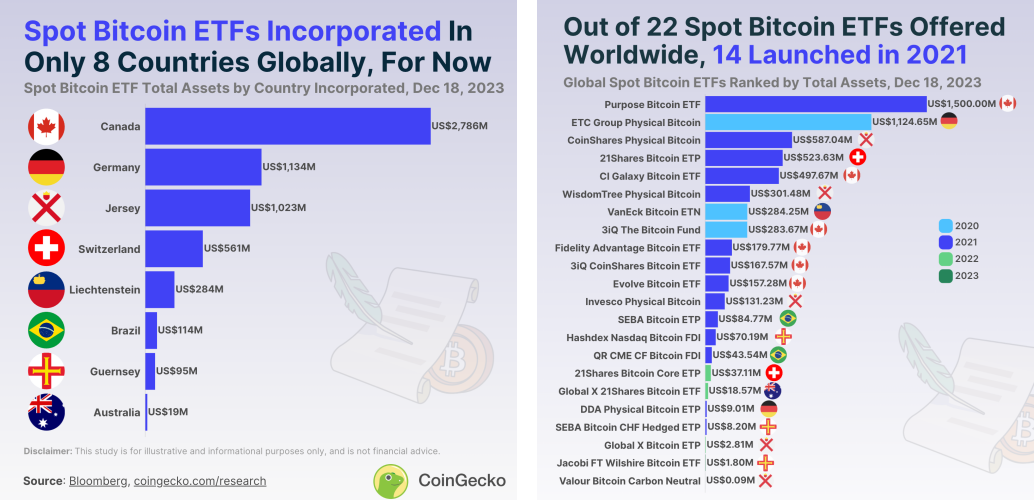

But the US was not the first. Bitcoin ETFs had been traded across eight countries prior to the US launch, with Canada and Germany being the most dominant. However, the instrument’s legitimacy has fundamentally changed now because of the SEC’s (begrudging) acceptance and the sheer size of US Bitcoin ETFs.

SO WHAT is going on?

Nine ETFs launched on 11 January offering Bitcoin in the US—together they already boast $4 billion in assets under management.

The record-breaking start for the ETFs will make Bitcoin a key narrative of Web3 in 2024—having already been one of the industry’s highlights last year, which proved a challenging 12 months for the industry. Beyond narrative, ETFs have the potential to shape the future of Bitcoin, the OG cryptocurrency that accounts more than half of the value of all crypto.

Here are a few trends to watch:

1. Validation

Bitcoin has had a remarkable rise, going from a fringe project used by geeks and anti-establishment believers to now a financial product that is traded by customers of top financial institutions such as BlackRock, Vanguard and Charles Scwab, all thanks to the launch of the US ETFs.

The advent of Bitcoin ETFs means that institutions and individuals can now invest in crypto through a compliant vehicle that doesn’t hold regulatory or legal uncertainty. It also doesn’t require custody (and its associated risks) of Bitcoin or trust in crypto exchanges or asset managers, which have less-than-stellar reputations thanks to the Three Arrows and FTX debacles. One UK survey found seven in ten wealth managers had discussed crypto with their clients. Now, those in the US have a regulated avenue.

This stands to benefit all of Web3 as Bitcoin remains a critical pillar in the decentralized economy. It tends to grab attention and headlines that bring new blood into digital assets, many of whom later dig deeper and discover more as the crypto rabbit hole takes hold. With Ethereum ETF approvals now mooted, the whole ecosystem stands to benefit.

2. A new pricing dynamic for Bitcoin and crypto itself?

It’s impossible to know how much US ETFs will impact the price of Bitcoin, but we can be sure that there will be an effect given both the size of ETF transaction volumes and the drastic difference between trading an ETF and directly trading crypto. Crypto exchanges are open for business 24/7 and enable trades of all sizes so long as the required liquidity is there to be matched. ETFs, like the markets they trade on, are far more limited in scope.

Research from CryptoSlate suggests that there are already discrepancies in price between ETFs (which use average price across multiple sources) and the live price of Bitcoin. Add to that the difference in settlement (ETF trades settle the next business day, rather than immediately on chain), and one can inevitably see arbitrage and shifting power dynamics.

Exchanges like Binance, KuCoin and ByBit are among the Asia-focused exchanges that have had a major impact on setting prices for Bitcoin and other cryptocurrencies due to strong trading volumes, but the growth of US ETFs could redress that balance.

“Hopefully, billions of dollars of flow will be concentrated in an hour-long period on exchanges that are less liquid and price followers of their larger Eastern competitors,” wrote Arthur Hayes, a high-profile crypto figure who was formerly CEO of Bitmex.

Beyond the unique transaction model, a surge in Bitcoin buying may also move the price by making it a more scarce asset. The Bitcoin network is designed to cap out at a maximum of 21 billion Bitcoins. Increased demand in the billions of dollars and the near-completion of Bitcoin mining—right now fewer than 1.4 million are left to mine—could have seismic pricing impact.

3. But oh the irony

Institutional adoption of crypto is being heralded as a major validation of the asset class, but there’s also huge irony. Bitcoin was designed as an alternative to the centralized, government-controlled financial system, and yet now it has been embraced by that same system.

Satoshi Nakamoto, the anonymous creator behind Bitcoin, released the Bitcoin whitepaper in October 2008—when the US markets were in full meltdown. The first (genesis) Bitcoin block mined by Satoshi in January 2009 was accompanied by a headline from The Times newspaper: “Chancellor on brink of second bailout for banks.”

It’s more than a little ironic, therefore, that the very financial institutions that caused the havoc surrounding Bitcoin’s birth and early adoption, are now providing it legitimacy and validation.

Bitcoin wasn’t a direct response to the 2008 financial crisis, that was coincidental. However, it powers a decentralized economy for those who don’t trust the world’s financial institutions. Now, it is being monetized (and potentially manipulated in the future) by those very same institutions.

The pragmatists in Web3 will argue that Bitcoin needs this type of adoption if it is to become more mainstream, and that remaining in the shadows and gray areas forever will never achieve impact. But the reality is that we still don’t know how this new bridge between old and new will pan out. We can marvel at how unlikely, and awkward, this marriage truly is. Maybe that’s what makes this development so exciting.

News bytes

Hong Kong is reportedly planning to follow the US with Bitcoin ETFs, although it will be flexible by allowing Bitcoin or cash to be used for ETF purchases, the US allows cash only—the first Hong Kong Bitcoin ETFs could arrive as soon as Q1

Meanwhile, South Korea, Singapore, Thailand and Taiwan are among the countries to warn or block brokerages from allowing their clients to investment in the US overseas offerings, typically they welcome SEC-enabled funds

It may have been a tough year, but the global crypto user base jumped from 432 million to 580 million in 2023, according to research from Crypto.com—the data claimed Ethereum users rose from 89 million to 124 million while the number of Bitcoin users grew from 222 million to 296 million

Thailand has lifted a $8,500 limit for retail investors purchasing digital tokens backed by real estate or infrastructure projects opening the potential for further real world asset opportunities in the country

Terraform Labs, the entity behind disgraced Web3 projects Luna and Terra which lost $50 billion in assets after collapsing, has filed for Chapter 11 bankruptcy in Delaware. Co-founder Do Kwon is awaiting extradition to either the US or South Korea after being arrested in Montenegro last year; he faces an SEC investigation in the US and a class-action suit in Singapore

That’s all for this week!

You can share your feedback, questions or requests via email to: sowhat@terminal3.io