DePIN is Web3’s buzziest topic—and it could be key to the AI revolution

Decentralized physical infrastructure network are offering new ways for cloud computing, mobile networks, EV charging and much more

Decentralized physical infrastructure network (DePIN) is one of the buzziest topics in Web3 right now. The concept is to build physical networks that can run without middlemen. File-storage, WiFi, mapping and artificial intelligence are just some of the industries where DePIN is showing the potential to change the game. There’s plenty of hype but can it convert to reality?

Let’s dive in.

Best,

What’s going on?

DePIN is one of the purest concepts of Web3. The core ideas are to remove the middleman from networks and let anyone participate in the network with rewards for their efforts.

The concept has become buzzy this year due to rising demand for compute power following the rise of artificial intelligence over the last 18 months. Getting hold of GPUs to run the complicated codes to power AI is not easy, but if you could access 10 or even 100 million computers, that could help build an entirely different network to do the same thing.

That said, DePIN has existed for some time albeit under the radar and with less sexy industries than AI, such as file storage and even mapping. There’s some skepticism but it does have the potential to at least offer different ways to build networks across a range of industries.

SO WHAT?

1. It’s like a gig economy for digital services

Filecoin was the first DePIN project to emerge in Web3. Its launch in August 2017 was so early that the concept itself hadn’t yet been defined. But Filecoin is a very easy way to understand the fundamentals of what DePIN is: decentralization.

Traditional cloud service providers like Dropbox use their own servers—combining both offline and online data centers—to let users access their files from anywhere and on any device. Filecoin flips that concept on its head by allowing anyone to provide their computer’s storage for the service to use in exchange for rewards. Instead of just using a service, a computer-owner can become (part of) the service and be compensated for it. It’s the digital equivalent of gig work but, unlike Uber and others, there’s no middle man taking profit. (Interestingly, DePin has the potential to tackle ride-hailing although given the industry’s profitability challenge it is a tough one.)

In essence, Filecoin showed the way that DePIN can be used to draw regards or revenue from under-utilized assets. The same way that ride-hailing allows a driver to make money from their car when it wouldn’t ordinarily be used, so anyone with a computer can put a fraction of their unused memory towards the Filecoin network. But imagine if your car could be used for ride-hailing without you having to drive it or without Uber taking its 30%.

Smart contracts, tokens and blockchain mean payouts to network participants are automated—while they also provide an asset that speculators can invest in. Together, that’s a critical piece of DePIN.

2. With enhanced security and cost-savings

The ride-hailing parallel works as a high level comparison for DePIN but it doesn’t tell the full story. DePIN is developed to remove the middle man, as mentioned, but also to provide scalability and security benefits that its advocates argue can make it superior to existing solutions.

Helium is one example. It is a decentralized wireless network that’s used to power consumer mobile services, internet-of-things (IoT) deployments and more. The network consists of hotspots which can be installed in a home or office, they earn tokens for providing connectivity to the network. There’s also a dedicated 5G cellular network in the US that rewards data providers. Like Filecoin, the idea is to tap a distributed community of providers to build a network—Helium bills itself as providing cost savings and higher quality service than existing solutions in many parts of the world. It has seen traction in IoT and other business-related services.

Areas like the following have a similar appeal:

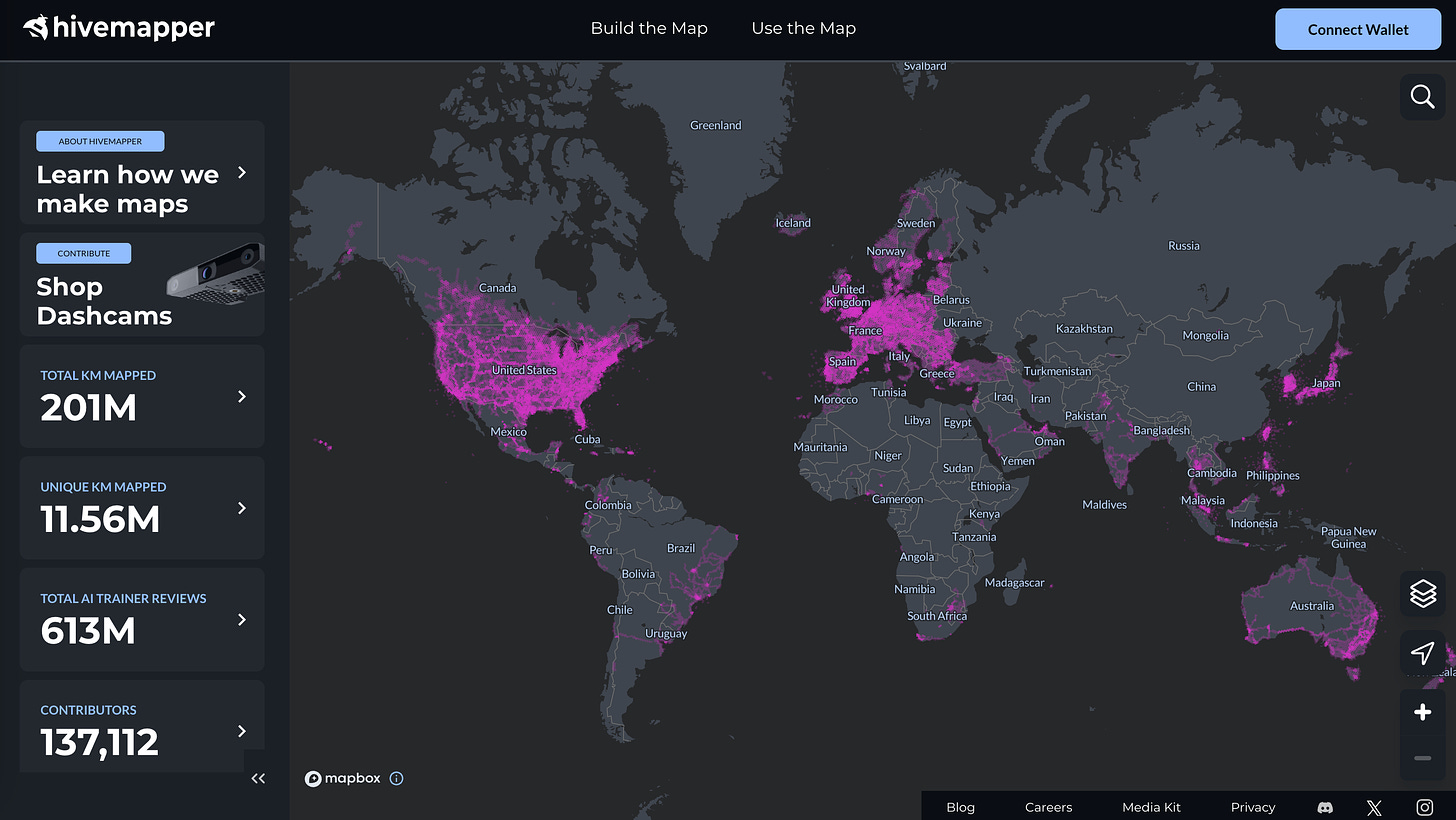

- Mapping—Hivemapper has mapped over 200 million km worldwide through its network of dashcam owners (see image below for more)

- EV charging—PowerPod lets users rent out their EV chargers and build new infrastructure networks

- Ride-hailing—Asia-based Tada cuts out middleman commissions for drivers

- Video-streaming—Theta is among the projects that reward P2P providers

But some of the biggest use cases are just emerging and they piggyback the hottest trends in tech right now.

3. The future of compute power

In case you’ve been living under a rock, artificial intelligence is the big story of the last two years in technology.

It doesn’t come without its challenges, however. GPUs (graphics processing units) are required to give computers the power to run AI and they are costly and, at times, hard to get hold off. Then, there’s the compute power that is needed to run them. Typically, companies use cloud computing and it is common to rack up huge bills, even for simple queries.

One US-based investor recently told SO WHAT that a typical AI startup is going to burn more than half of its fundraising on compute bills, such is the need to train AI models to develop their product. And that’s without taking into account the cost of GPU access.

This has opened a window for DePIN. Projects including Render (decentralized GPU based rendering solutions) and Akash (open-source, decentralized, marketplace for cloud computing) followed the lead of Filecoin and others by offering services to meet this increasing demand.

What makes these networks particularly interesting is their tokens. They not only provide an opportunity for traders to take a position on the growth of AI, but it allows another dynamic: investment. The same way that AWS, Microsoft Azure and other cloud providers provide credits, so DePIN networks can provide their tokens to their target audience—offering further upside in the network they are using.

It is still early days for DePIN in the AI and cloud revolution. A number of prominent projects are among the top 50 cryptocurrencies based on the total value of all their coins, but that is based more on speculation than actual use cases for now. This year, it will be fascinating to see what deployments roll out and whether these networks can prove their theories in reality.

News bytes

Chengpeng Zhao, the co-founder and former CEO of Binance, was sentenced to four months in prison for finance crimes

MicroStrategy is best known for buying Bitcoin but it recently announced a protocol for decentralized identification, which would allow identification verification without needing to repeatedly present documents

Block, the payment firm co-founded by Jack Dorsey that was formerly called Square, said it will invest 10% of its gross profit from Bitcoin-related services back into Bitcoin—the firm sold $2.7 billion in Bitcoin in Q1 2024

Stock trading platform Robinhood is the next to come under fire after it received a notice of enforcement from the SEC while the commission is also examining financial transactions from Block following claims it processed crypto transactions for terrorist groups

Kenya may focus on Bitcoin mining after the government invited one of the largest miners in the US to consult it over policy

BlackRock’s head of digital assets believes pension funds and wealth funds will soon be buying Bitcoin ETFs

Coinbase posted impressive financials including net income of $1.18 billion, compared to a year-ago loss of $78.9 million, while Tether, the firm behind Web’s top stablecoin, announced it made a $4.52 billion profit in Q1 2024

That’s all for this week!

Share your feedback, questions or requests via email to: sowhat@terminal3.io