Circle IPO: A unique money printing model that will divide investors

GM,

Circle’s IPO has been talked about for a number of years, and finally it just took a big step to reality after the US firm—which issues popular stablecoin USDC—filed to go public on the New York Stock Exchange (NYSE).

This week we’re digging into its 200-page plus financials to give you the low down on this major crypto IPO.

Best,

What’s going on?

Going public has long been a key objective for Circle. In 2021, it joined the wave of companies trying to list through a merger with a SPAC (Special Purpose Acquisition Company) but its deal fell apart more than a year later.

The SPAC craze was a passing fad, but Circle’s intention to list on the NYSE is no joke—even though its papers were filed on April 1.

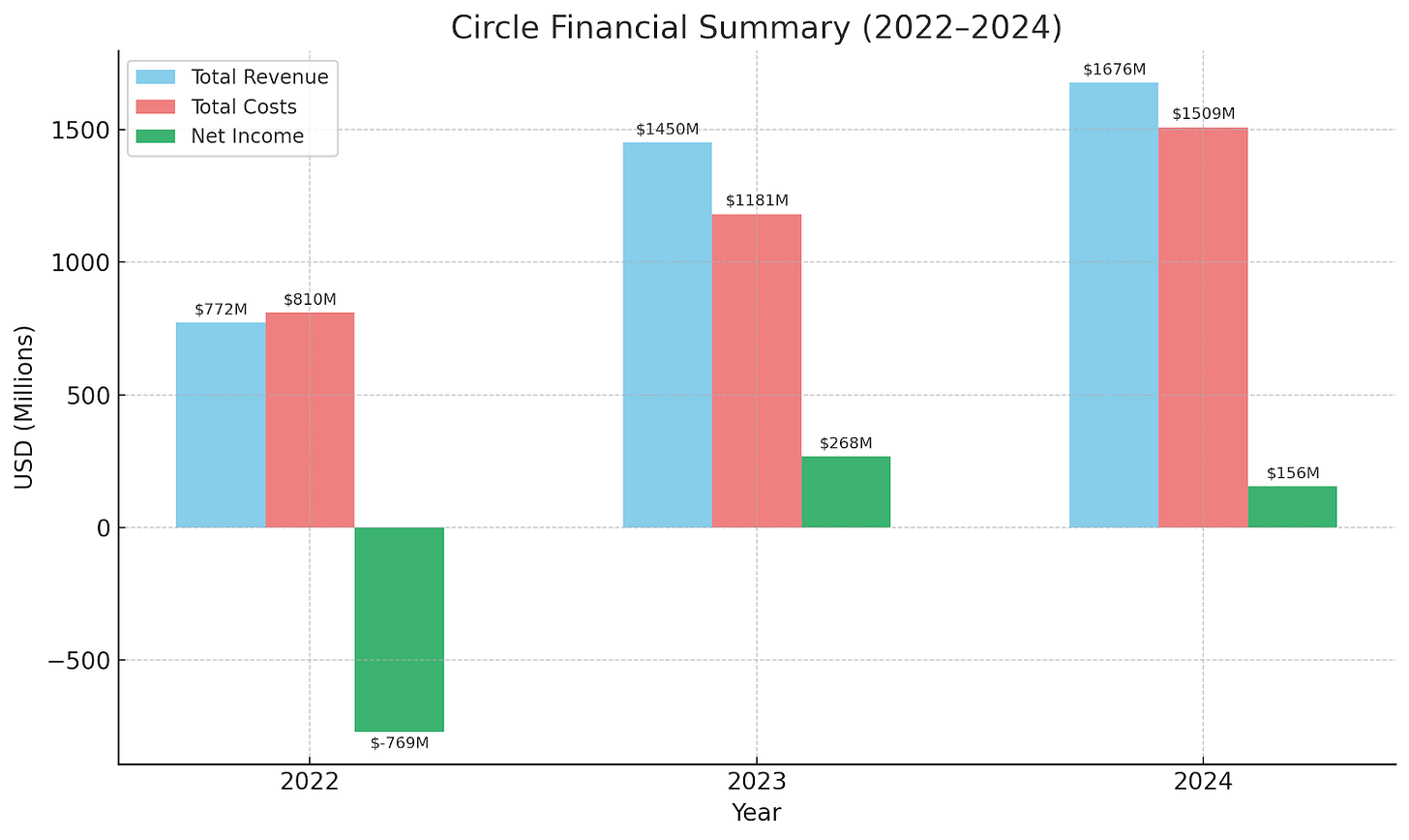

The Circle business has grown even stronger during the intervening period, although that hasn’t played out in top line numbers. Circle’s revenue more than doubled over the last two years—from $772 million in 2022 to $1.45 billion in 2023—but it is aiming to go public at $5 billion, a small increase on its proposed $4.5 billion valuation for the SPAC deal.

So what do its hopes look like?

SO WHAT?

1. A simple model that makes money—but at a cost

Circle is a money printing business in every sense of the word.

The model is simple. Circle issues two stablecoins USDC, which is pegged to the US dollar, and EURC, which is pegged to the Euro and available in Europe.

USDC currently has a circulating supply of around $60 billion, and Circle’s primary revenue comes from income on that reserve via yield from short-term US Treasuries.

It is lucrative:

In 2024 Circle made $1.66 billion in reserve income, up from $1.4 billion and $735,000 the two years prior.

But it comes at a cost.

Circle paid out over $1 billion in distribution fees last year—that’s money to the networks, exchanges and other partners whose use of USDC (and EURC) on their platforms creates demand.

Beyond those whopping fees and other costs—salaries are the second largest spend at $260 million—Circle made a net profit of $156 million in 2024.

That’s decent for a company with 900 employees, but it is far from the wild profitability that rival Tether claims.

Tether said its net profit for 2024 was $13 billion, but there’s little chance of the company becoming publicly traded. It claims its treasury reserves are $113 billion, according to its most recent report—which it says is audited by BDO.

That’s down to a very different approach to operations. While Circle has designed itself to be regulation-friendly since its inception, Tether has been plagued by questions and suspicion around its treasury and whether it is able to back its USDT stablecoin fully.

Without Tether’s accounts, it is hard to make a comparison but Circle’s reliance and partners—as mentioned above—looks to be another key difference. One strategic friend in particular will worry prospective Circle IPO investors, even though it is an early and crucial partner.

2. The Coinbase factor

Coinbase is a crucial part of the Circle business—it is mentioned by name more than 100 times in Circle’s IPO prospectus.

The US crypto firm helped create the Circle business we see today when the two joined hands to launch USDC in 2018. Until that point, Tether’s USDT had been the undisputed stablecoin of choice.

Circle was designed to be fully transparent with its reserves and natively built for blockchains, two areas USDT was frequently criticized for. Coinbase was key to distribution as it instantly put USDC into the reach of tens of millions of users.

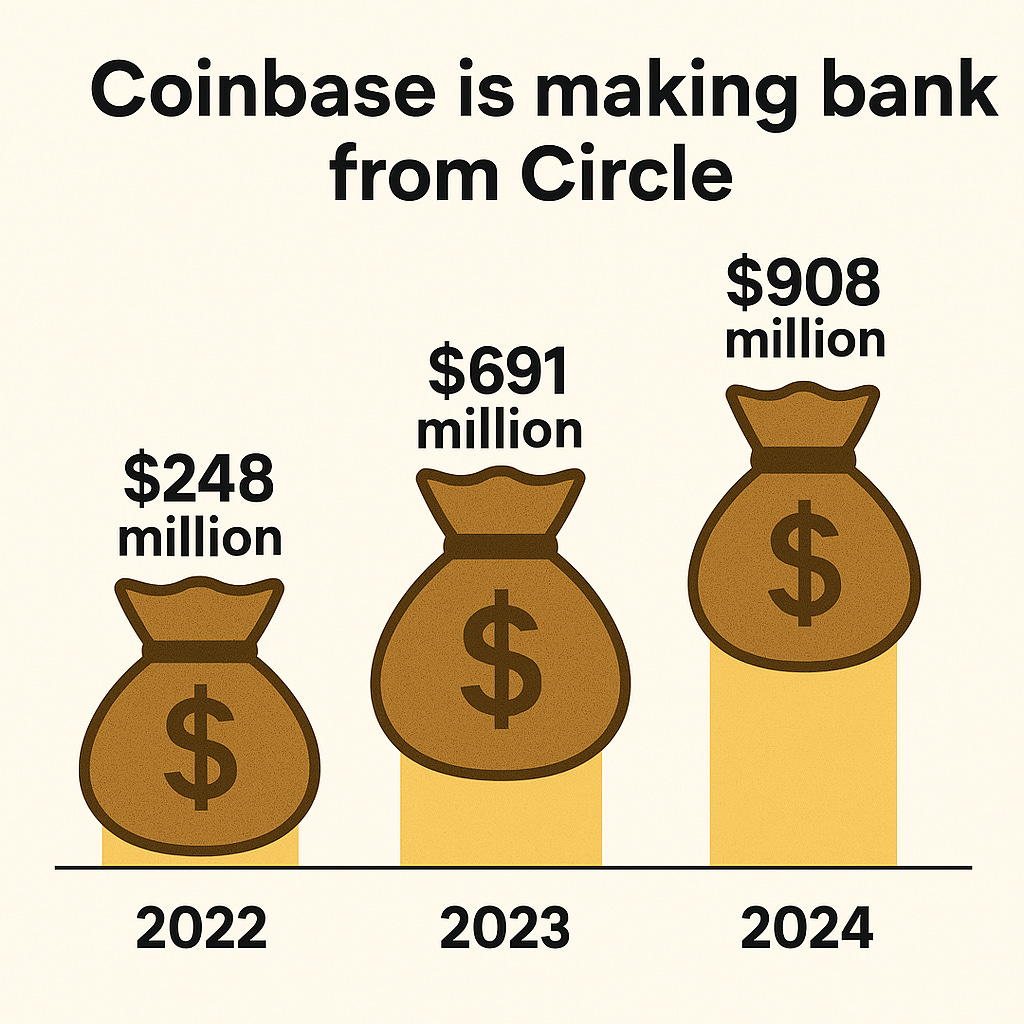

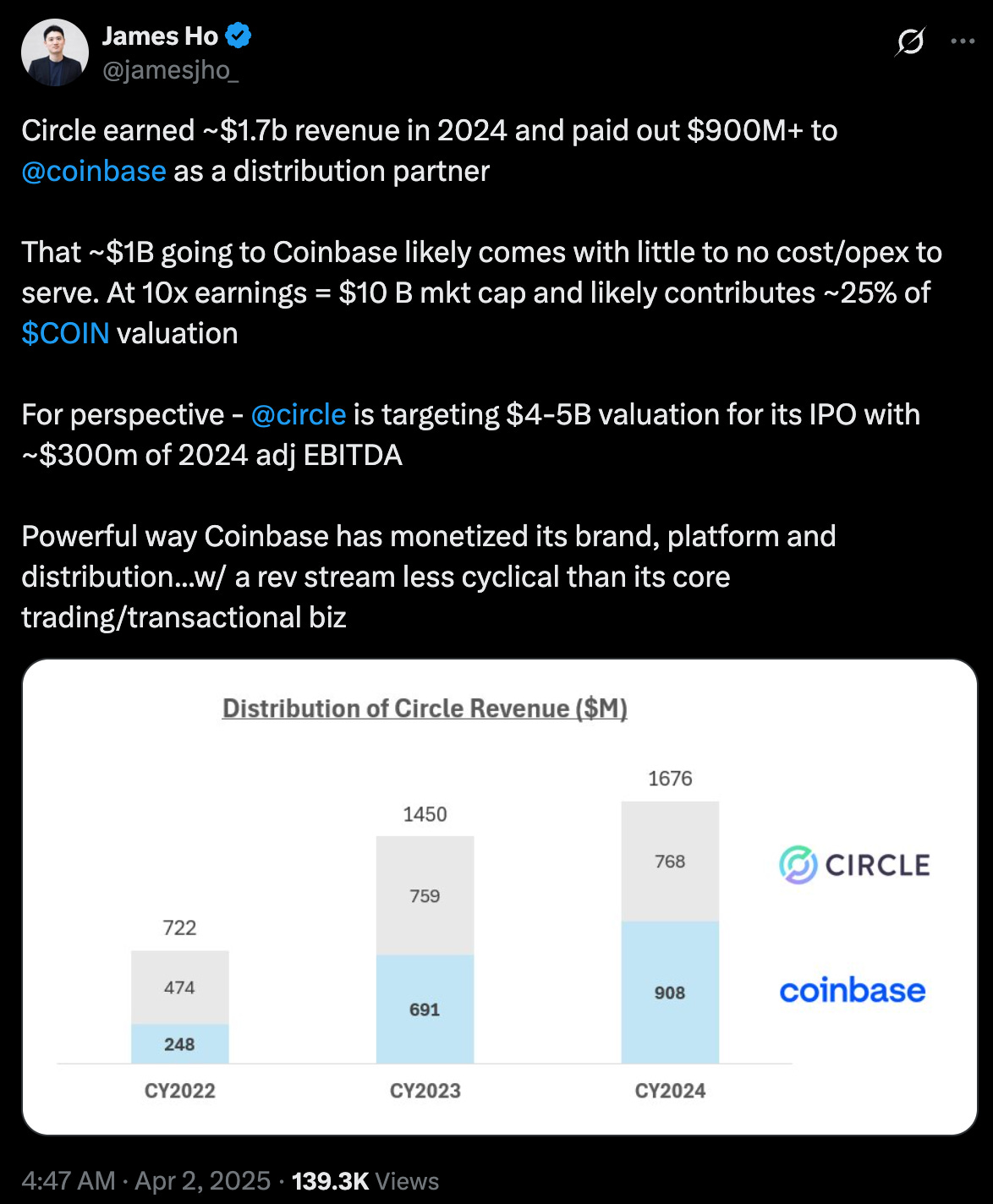

An initial 50-50 joint venture was restructured in 2023 to give Circle full ownership. Today, Coinbase has a minority stake in the Circle business but it also retains a punchy 50% cut of the net revenue from USDC reserve assets, effectively splitting the income with Circle.

That arrangement has been very lucrative for Coinbase: bringing in $908 million in 2024, up from $248 million in 2022 and $691 million in 2023.

This cost is part of the distribution bill that weighs on Circle, and the company candidly says it expects to see the costs increase with more partners on board. Increasing the amount of partnerships is, of course, crucial to growing Circle’s overall revenue. In this case, it is the cost of doing business with partners who are central to the model.

Coinbase is the main driver, but other exchange partners are cosying up. Circle struck a deal with Binance to keep at least $1.5 billion of USDC in its exchange for liquidity. That arrangement included an upfront fee of $60.25 million alongside an undisclosed monthly fee based on Secured Overnight Financing Rate (SOFR) from the Treasury.

This deal looks like the blueprint for increasing distribution without the lavish payouts that Coinbase enjoys. But still Coinbase remains a crucial partner for Circle.

3. USDC brand potential

Circle is said to be targeting a valuation of $5 billion for its IPO, which has received a mixed reaction.

Impressive top line revenue and a tight partnership with Coinbase, the bellwether for publicly traded crypto companies, is the fuel for some to argue that $5 billion is a low target.

But the counter-argument is that Coinbase is a millstone that’s weighing down the Circle business.

Either way, the reality is that USDC is incredibly well positioned in the market today. Unlike Tether, Circle has been built with transparency and regulation in mind—you’d imagine that it is not going to take much adjustment or adaptation to reach the compliance levels required to be a NYSE-listed business.

USDC is the standout contender as a regulatory compliant stablecoin, and it has partnerships that run beyond crypto. BlackRock plans to use USDC exclusively for a money market fund, and cooperate in other areas, too.

There’s little doubt that financial institutions and even governments will introduce stablecoins within the confines of market verticals or geographies. USDC could be a broader bridge to connect them and encourage liquidity. Even the name, USDC, is an ideal brand in a world in which there’s fewer names and ticker symbols left for new stablecoins.

There may be pressure applied from stablecoin platforms, such as M Zero Labs, which enable any company or even product to easily develop and deploy their own stablecoin. That eases or even entirely removes the need to use USDC within their product, giving the issuer opportunities to optimize the user experience and generate income.

Circle could potentially offer something similar in the future, or enter the space through an acquisition, but that’s some way out for now. First up, Circle needs to convince investors of the benefits of its distinctive business model—and address the polarizing role Coinbase plays in it.

News bytes

We wrote about the convergence between Web3 and traditional finance in our last issue, and just days later, Ripple agreed to buy prime broker Hidden Roads for $1.25 billion

There’s more on that convergence: The Wall Street Journal reports that Circle, BitGo, Coinbase and Paxos are all applying or consider whether to apply for bank charters or licenses in the US

The Singapore Stock Exchange plans to launch Bitcoin perpetual futures in the second half of 2025

Panama City Council voted to become the first government institution to accept cryptocurrency payments—citizens can pay taxes, fees, tickets, and permits using BTC, ETH, USDC, and USDT

Cryptocurrency comparison index CoinGecko released a thorough analysis of Q1, noting that the total cryptocurrency market fell by nearly 20% in the first three months of 2025 and plenty of other data

That’s all for this week!

Share your feedback, questions or requests via email to: sowhat@terminal3.io