Can MANTRA regain trust and momentum after a 95% token price drop?

GM,

Launching a token can make founders of Web3 startups rich—and in far quicker time than it takes to be acquired or go public in an IPO. Cryptocurrency markets are liquid, but that can also spell peril for companies if their token price falls.

That’s the subject of this week’s newsletter: how one company that’s leading an emerging Web3 financial market got kneecapped overnight when its token plunged by 90%.

Is this game over for MANTRA? Let’s dive in.

Best,

What’s going on?

In January, MANTRA Network was the toast of the Web3 industry after it announced a $1 billion deal with DAMAC Group, one of the largest property development companies in the Middle East, to convert ownership rights into digital tokens.

MANTRA launched its mainnet—fully launching its blockchain—in October 2024 with the goal of tokenizing real-world assets (RWA) such as property, bonds and more. Partnerships like DAMAC coupled with renewed belief in blockchain-based services thanks to the growth of institutional investors entering Web3—catalyzed by the launch of US ETFs—saw MANTRA’s token ($OM) soar to nearly $8.50 on 24 February.

But, just over two weeks later, $OM crashed to $0.59 after losing 95% of its value overnight.

The price crash was triggered by a huge volume in token sales, but exactly who sold and why isn’t clear.

Critics accused the MANTRA team of selling a large volume of their tokens. Others accused investors of doing the same.

JP Mullin, MANTRA’s founder, blamed the centralized exchanges (CEXs) that trade $OM for allowing “reckless forced closures.” Millions of dollars-worth of token sales were “initiated without sufficient warning or notice,” Mullen said.

Today, the price is just over $0.44 as the company fights hard to overturn a narrative. Can it really turn the narrative after a token death spiral?

SO WHAT?

1. Confidence is lost

Narrative plays a huge part in pricing cryptocurrencies. Many crypto businesses are still at an early-stage which means that traders buying their tokens are betting on their future growth with limited fundamentals at best, or none at worst. Unlike stock trading with its revenue-ratios and other metrics, most crypto valuations are based on reputation or narrative.

So when a token like $OM crashes, the ‘value’ is hard to rebuild.

The fact that the cause of the sell-off is unknown, and the situation becomes murkier and less certain. The trust and confidence that underpinned every partnership, pitch deck, and community call was shattered.

So while the fundamentals and deals done haven't collapsed?, many looking in don’t have the same belief as before. Potential partnership deals that would give investors confidence, may now be in jeopardy due to the collapsed token price. Those would have been the very partnerships needed to revive the confidence in the project.

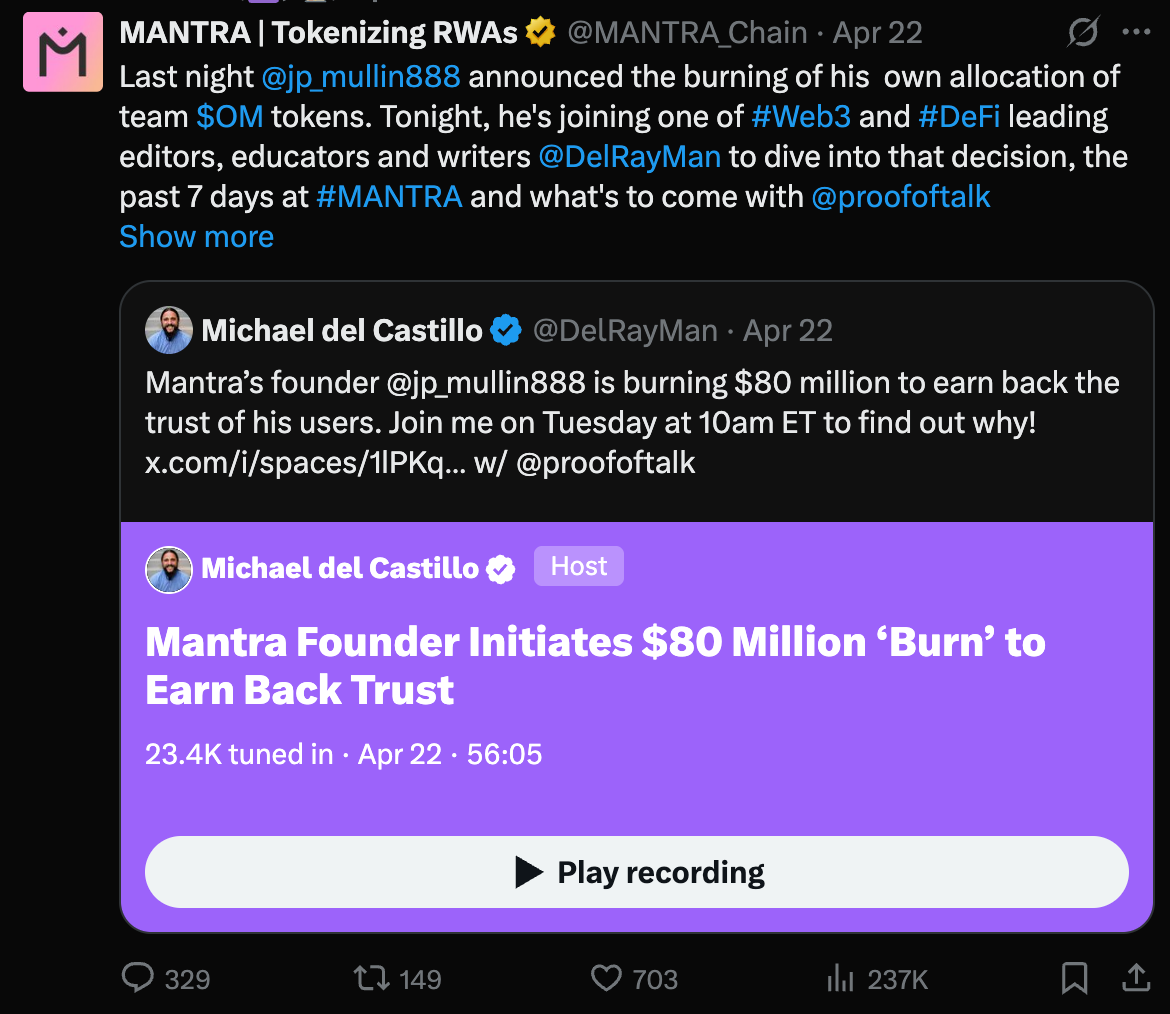

The MANTRA response has focused around burning tokens—meaning the founders and team have chosen to permanently remove their own token allocation.

This move is aimed at increasing scarcity of the token to give it more value, and showing that the core insiders behind MANTRA are prepared to forgo some of their profits from the business in order to help regain its position. In other words, they’re prepared to give up personal gains to see the business prosper.

MANTRA burned 300 million $OM tokens—that’s worth around $120 million at current rates, or $3.4 billion at the token’s all-time high. Half are from Mullen, the founder, with the remaining half belonging to the team and core contributors. Mullen said investors and the community “can decide if I have earned it back” further down the line.

The company also removed some validator partners, whose job is to manage the network, and will onboard new validators.

Returning confidence is no easy thing, but sacrificing monetary gains and changing those who manage the network have been the main focus.

2. The challenge of centralized exchanges

Mullin decried the role that CEXs play with crypto companies that issue a token.

They’re unavoidable right from the start. They offer liquidity, visibility, and user access for token launches, but they come at a serious price. Projects can expect to spend upwards of $100,000 in stablecoins and more in their own token to list on mid-tier exchanges. The price for the most popular exchanges is higher.

Even once your token is listed, the process is challenging:

- Price discovery on CEXs is opaque

- Prices can be easily manipulated

- Prices often move independently of real fundamentals

There’s also no transparency around volumes. And volume is very much needed. Tokens that don’t meet minimum standards are delisted from exchanges—that means most companies need to employ market makers to keep volumes up. That’s another costly line item.

Yet for all of that, Mullin argues that CEXs have the capacity to sink a token price, as happened with $OM. He said MANTRA is working with CEXs to prevent similar incidents in the future and he said he believes that it is an issue for the whole industry.

Most exchanges want to work with major cryptocurrency companies because they need their tokens, but there have been examples that follow $OM’s struggle.

Decentralized exchange (DEX) Hyperliquid faced a crisis when two Binance-linked accounts were accused of manipulating a memecoin that could have cost it $230 million. Hyperliquid used a centralized method to close the trade, but Binance and fellow CEX OKX were accused by some as trying to destabilize Hyperliquid, which is seen as a threat to their centralized businesses.

3. The perils of launching a token

Tokens are favored by many crypto startup founders because they give them potential exit liquidity and incentives. Rather than having to hope for an exit via IPO or acquisition—which happens to few companies—tokens can allow them to slowly vest their position in the business. Investors certainly enjoy the easier liquidity.

In an ideal world, that’s combined with interest in the token that sees retail investors buy in and generate demand.

But, once a token is live, your business becomes inseparable from its price chart. And sentiment is often the biggest driver. That has led to the growth of narrative-centric marketing, which ranges from a glut of paid-advertorial opportunities on crypto media, to armies of influencers ready to shill the newest token in exchange for money, pay-to-play speaking events and much more.

Reliance on centralized exchanges continues to be a major bugbear for all—one that is impossible to avoid. Even though DEXs like Uniswap and Hyperliquid have significant trading volumes each day, they don’t have the size of Binance, OKX and others—which also help widen the base of traders holding a token.

MANTRA’s redemption is going to be a major arc to keep an eye on. In spite of the growth in belief around institutional Web3 services and some impressive deals of its own, the company finds itself battling a tough fight. It’s one that Mullen said has hit his team hard—with many struggling to sleep, for instance.

Whether MANTRA can recover will depend not just on fundamentals—but on whether it can win back the one thing it lost overnight: trust.

News bytes

We recently wrote about consolidation from crypto exchanges, which are adding traditional finance features, and that trend was epitomized when Coinbase agreed a deal to buy derivatives platform Deribit for $2.9 billion

Robinhood continued the consolidation in trading exchanges with the acquisition of Canada-based digital asset platform WonderFi

Crypto and stock trading platform eToro listed on the Nasdaq above the predicted range: which saw it raise $310 million at a $4.2 billion valuation

Tether announced its upcoming AI product—called QVAC (QuantumVerse Automatic Computer), it will be able to run AI apps and agents on devices without relying on the cloud or centralized services

Thailand is planning to raise $150 million using a government investment token that would be tied to national bonds—details are a little light at this point, however

JPMorgan just settled its first transaction on a public ledger

That’s all for this week!

Share your feedback, questions or requests via email to: sowhat@terminal3.io