Bitcoin’s halving is complete—what happens next is pivotal for all of Web3

GM,

It finally happened. Last week saw the latest Bitcoin halving, an event that decreases the rewards received by Bitcoin miners—who are integral to the process of transactions and new coin minting.

If you heard about the halving but don’t really get it, this is the issue for you as we will break it down and explain. As always, what happens next is tough to predict but the possibility for anything is exactly what makes Web3 the most fascinating industry to be a part of.

Best,

What’s going on?

Bitcoin’s fourth halving took place on Friday 19 April. In short, the event reduces the rewards miners earn by half—hence the name—moving from 6.25 Bitcoins previously to 3.125 Bitcoins.

Halving is baked into Bitcoin by design to control the supply of newly minted tokens that enter circulation and retain a level of scarcity to maintain (or increase) the value of Bitcoin.

Bitcoin was developed to reach a maximum supply of 21 million, after which no new Bitcoins can be minted. Right now, there are more than 19.6 million in existence. It is estimated that the remainder would be reached by around 2140. The halving helps ease that supply rather than just dumping new tokens, which will impact the price and desirability of Bitcoin.

That’s the what and why, but the impact of the halving runs deep affecting many different areas of the Web3 ecosystem.

SO WHAT?

1. The miners front and center—and highly influential

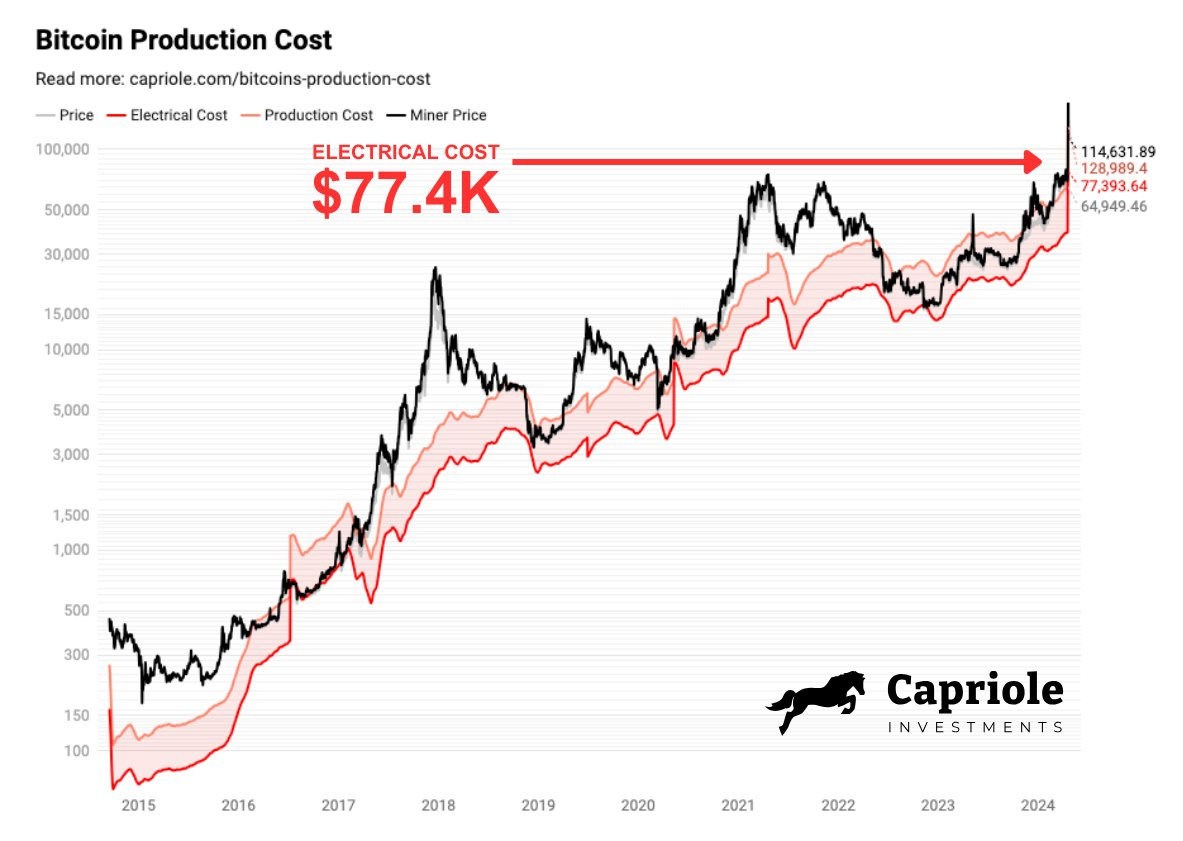

Miners are what make Bitcoin tick. They process transactions and mint new Bitcoin to maintain supply levels and in turn take revenue from doing so. Mining is where the lion’s share of revenue comes from but, as stated earlier, that’s taking a hit following the halving.

The reduction in rewards likely means that small mining companies will struggle and there could be consolidation in the market. The days of smaller enthusiasts mining Bitcoin for great profit—early on miners could make 50 Bitcoin for each block mined—are over.

That’s another example of Bitcoin growing up, as we wrote when we summarized 2023. ETFs have changed price discovery by enabling traditional investors to buy into Bitcoin, and hundreds of billions of US dollars have rolled in. Similarly, the continued professionalization is turning to the mining industry, too.

Indeed, many mining firms are public companies—unsurprisingly, several of the largest firms posted significant stock price rises on the day of the halving.

2. Living up to great expectations

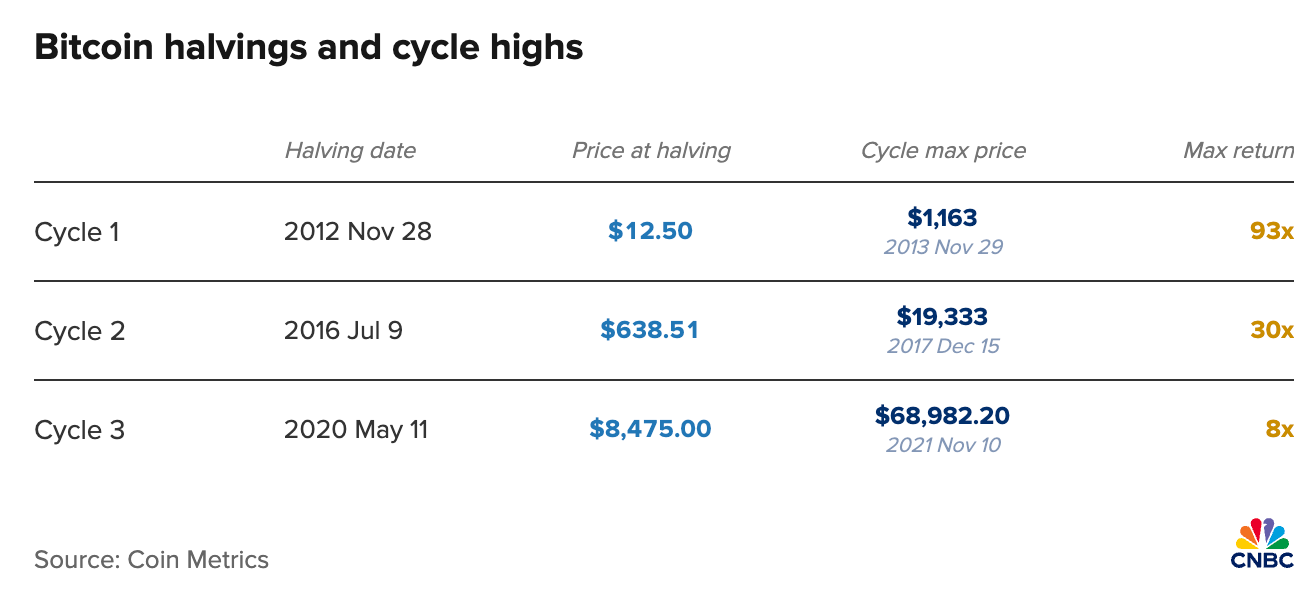

Halving sounds like a negative influence but it tends to foreshadow a significant rise in Bitcoin pricing based on previous history, as this graphic from CNBC shows.

We don’t make price predictions here, but typical post-halving dynamics often mean miners sell less of the Bitcoin that they mine due to the lower reward outcome. That can relieve selling pressure which can lead to price stability or increase.

But the Financial Times reported that miners have hoarded nearly $3 billion in Bitcoin that would ordinarily have been sold ahead of this latest halving. That is reportedly in anticipation of a future price rise as the effects of the halving play out.

The health of Bitcoin’s isn’t just a topic that’s of interest to those who own Bitcoin, it can impact the price of all other cryptocurrencies and thus the sentiment of the entire Web3 industry itself. If Bitcoin does go on a tear and reach the heights that some are predicting—such as surpassing $100,000—then it could lead to price appreciation across the market. Bullish sentiment in the market can be beneficial for all areas of the Web3 economy. Trying to introduce decentralized versions of gaming, social media, data collection or more becomes harder when sentiment is low and naysayers are stronger.

3. But this time it will be different

We often say in SO WHAT that the future of Web3 is hard to predict. With new technology emerging almost weekly and trends shifting regularly, it is hard to predict outcomes with great certainty at the best of times. For Bitcoin, in particular, these are unprecedented times for a number of reasons.

Bitcoin ETFs have revolutionized price discovery in ways we are still not fully aware of. US ETFs are responsive for tens of billions of Bitcoin purchases each day, inflows that the Web3 world has never seen before. With countries like Hong Kong following suit, albeit with less purchasing power, the price dynamic is very different today.

Likewise, the halving has brought new innovation, as we explained in last week’s newsletter. Runes, a new protocol, enables the Bitcoin blockchain to be used to create memecoins and other fungible tokens.

It is early days, but that has already led to a cluster of new tokens taking over including Satoshi Nakamoto coin, Dog To The Moon and Rune Pups. Coindesk reported that retail investors have spent 78.6 BTC in fees (nearly $5 million) on gas and transaction fees alone to mint new Runes projects. That’s tipped to continue and create ‘Memecoin season’ on Bitcoin. That’s in addition to the nascent world of Bitcoin NFTs which was created with the launch of Ordinals last year.

This innovation amounts to new activity, utility and mining fees that did not exist before and it is sure to have an impact on how Bitcoin performs after the halving, and that will in turn have major influence on the entire Web3 industry.

Strap in because it is looking like it’ll be quite the ride this year!

News bytes

CoinShare published a detailed report diving into the economics of Bitcoin mining after the halving

Messaging app Telegram’s in-app wallet adding support for Tether’s USDT stablecoin as it looks to broaden its appeal to the apps 900 million monthly active users

Japan’s Liberal Democratic Party published a white paper [download link] that proposes making the country a Web3 hub through policies including legal status for DAOs, a Bitcoin ETF, stablecoins and crypto tax reform

Thailand may become the latest Asian country to ban international crypto exchanges, following the lead of India and the Philippines—local exchanges must receive a license to operate in Thailand

Shib Inu (yes, the memecoin) raised $12M via a token sale to finance a new layer-3 blockchain that it claims will allow users to “to both be private yet still gain credentials to verify their identity”

That’s all for this week!

Share your feedback, questions or requests via email to: sowhat@terminal3.io